Pensions: Nagaland owes Rs. 211.40 crore to NSDL

Our Correspondent

Kohima | February 17

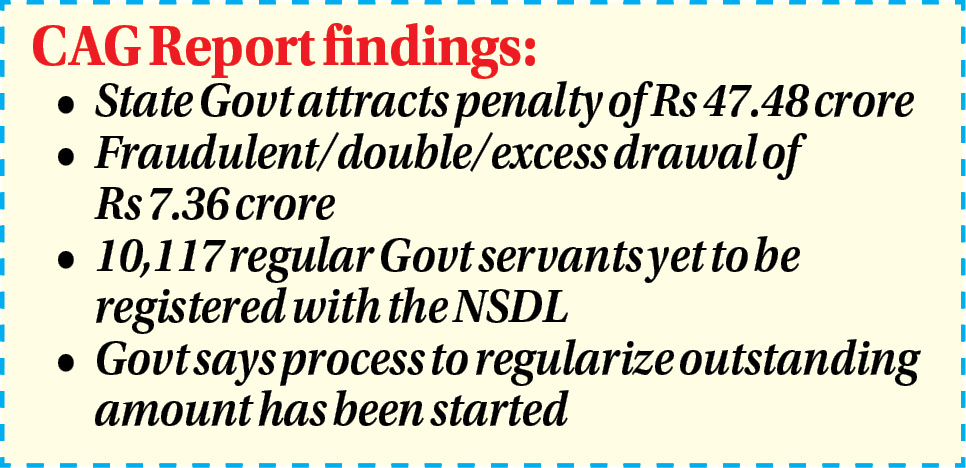

As of March 2018, the Government of Nagaland has not remitted Rs. 211.40 crore to the National Securities and Depository Limited (NSDL), thereby attracting a penalty of Rs 47.48 crore.

This was revealed in the State Finances Audit report of the Comptroller & Auditor General of India (CAG) report for the period 2017-18, which was tabled at the NLA recently.

The report further pointed out that failure of the Drawing and Disbursing Officers and Treasury Officers to exercise prescribed checks has resulted in fraudulent/double/excess drawal of Rs 7.36 crore, out of which Rs 5.73 crore was yet to be deposited.

To these findings by the CAG, the State Government in its response stated that employees’ and government’s contribution to NSDL/Trustee Bank could not be remitted due to non-generation of Permanent Retirement Account Number (PRAN) in respect of employees who had either submitted the registration forms with delay or not submitted the same due to not having Permanent Account Number, Aadhar and Bank Account etc.

The CAG report meanwhile observed that failure to remit the funds would lead to depletion of the New Pension Scheme (NPS) Corpus and increase the liability of the government and the risk of failure of the scheme.

In this, the government responded that an online e-NPS has been introduced and the process to regularize the outstanding amount has been started.

Further, the CAG report informed that 10,117 regular Government servants appointed after January 1, 2010 were yet to be registered with the NSDL and were not allotted PRANs.

It stated that expenditure on pension in Nagaland has increased by Rs. 170.63 crore (15.60 %), from Rs. 1093.47 crore in 2016-17 to Rs. 1264.10 crore, including Rs. 62.44 crore on new pension scheme in 2017-18.

The pension payment was Rs. 179.10 crore more than the assessment made by 14th Finance Commission (Rs. 1085.00 crore).

However, it was Rs. 158.35 crore less than the assessment made by the state government in its MTFPS (Rs. 1422.45 crore) for the year 2017-18, it said.

During the year 2017-18, there was an opening balance of Rs. 200.53 crore and Rs. 130.00 crore (Employees+ Employers share) was contributed to the fund.

Out of this, an amount of Rs. 119.13 crore (Employees contribution Rs. 56.69 crore and employers contribution- Rs. 62.44 crore) was transferred to the NSDL/Trustee Bank, leaving a balance of Rs. 211.40 crore (Employees contribution Rs. 103.68 crore and employers contribution Rs. 107.72 crore) un-transferred as on March 31, 2018.

The report stated that the accumulated balance was due to persistent short transfer of funds to NSDL/Trustee bank over the years.

Over the last five years, the state government has also acquired the interest liability of amounting Rs. 47.48 crore on the amount not transferred to NSDL.

The CAG recommended that the state government should ensure that employees recruited on or after January 1, 2010 are fully covered under the NPS from the date of their recruitment by ensuring that employees’ contributions are fully deduced, fully matched by government contributions, and fully transferred to NSDL/Trustee Bank in a timely manner to avoid interest liability.