Union Finance Minister Nirmala Sitharaman launches Chief Minister's Micro Finance Initiative at the Banker's Conclave/Credit Outreach Program in Kohima. (Photo Courtesy: Twitter)

.jpg)

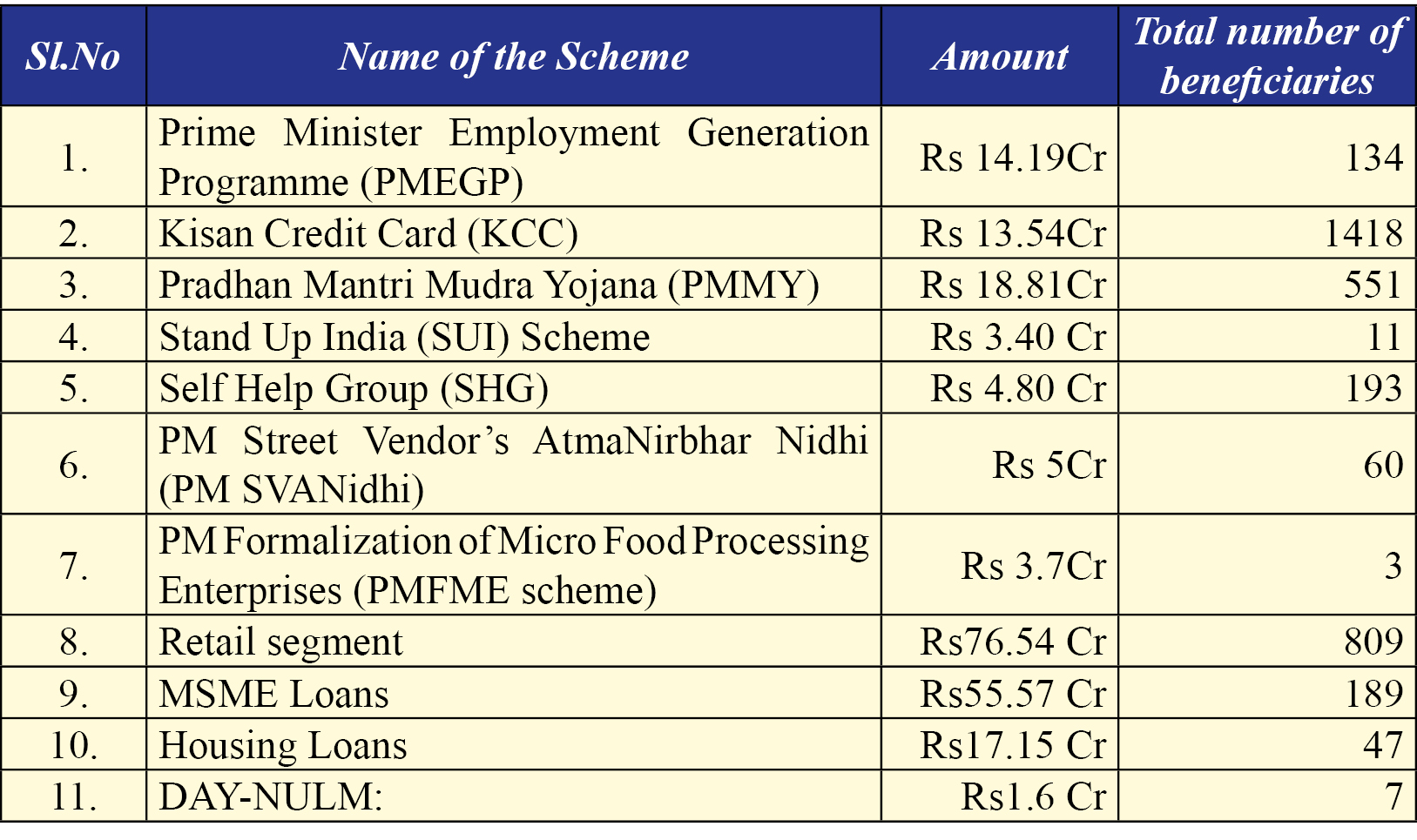

3422 borrowers receive Rs 205 cr under 11 schemes

Morung Express News

Kohima | August 23

To encourage credit for carrying out economic activities, an omnibus scheme of the much awaited Chief Minister’s Micro Finance Initiative was launched by the Union Finance Minister Nirmala Sitharaman on August 23.

Marking the launching of the scheme during the Credit Outreach Programme & Launch of New Schemes and Projects at Capital Cultural Hall, Kohima today, cheques were handed over to 16 beneficiaries, one from each district of Nagaland.

An amount of Rs 65 crore has been earmarked for this scheme where subsidy and interest subvention against identified activities in the agriculture & allied sector including processing units, MSME, etc., will be provided to eligible beneficiaries.

As per the brochure, the objective of the scheme is to increase farmer’s income, encourage self-employment and entrepreneurship development, inculcate a sense of credit disciple, boost private enterprise and improve the agri-marketing network and infrastructure in the state.

Funding pattern

The funding pattern under this scheme is 60:30:10 as in bank loan 60%; back ended subsidy by the state government 30% and beneficiary contribution of 10%.

Besides, the state government will provide interest subvention of 4% to KCC loans and credit linkage to farmers, and also the 3% provided by the government of India on prompt repayment of dues by the borrower.

The maximum ceiling admissible under this scheme is Rs. 15 lakh for each beneficiary while the moratorium period is up to maximum of 6 months and repayment period is of maximum 7 years.

Farmers, entrepreneurs, unemployed youths, Self Help Groups, Farmers’ Producers Organisation/Company and Cooperative Societies can apply for the scheme.

Token Cheques of Rs 205Cr to 3422 borrowers

Meanwhile, in a major boost to increase the credit flow in the State, a total of Rs 205Cr was handed over to 3422 borrowers for 11 major schemes by the Union Finance Minister today.

This was initiated by all the Banks & Financial Institutions operating in the state of Nagaland under the aegis of State Level Bankers Committee (SLBC) with the total in principle sanction amount of Rs 223 crore to 3837 borrowers. (See table)

Meanwhile, Sitharaman also flagged off a mobile ATM Van to serve the rural people in Mokokchung district to spread financial literacy and also offer doorstep banking services to the people. It was funded by NABARD, the apex development bank in charge of rural credit and development.