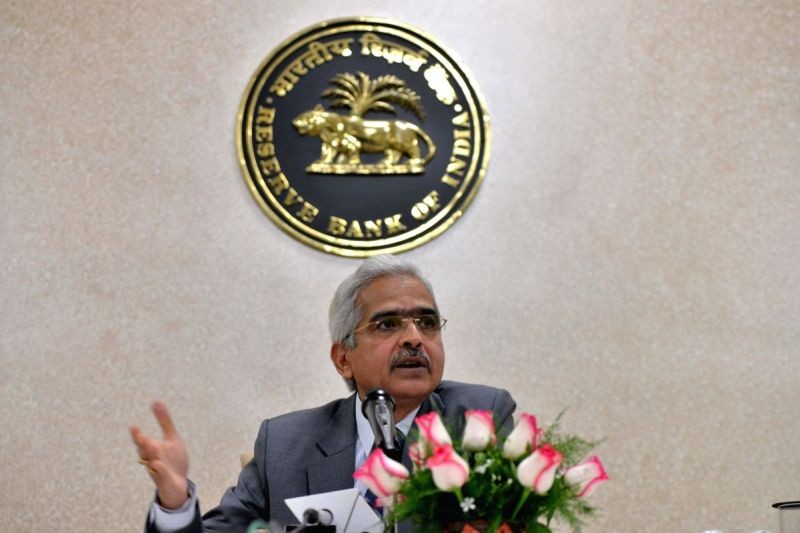

Reserve Bank of India (RBI) Governor Shaktikanta Das addresses a press conference in New Delhi, on January 7, 2019. . (IANS File Photo)

MUMBAI, FEBRUARY 5 (IANS): In order to incentivise new credit flow to the micro, small, and medium enterprise (MSME) borrowers, Scheduled Commercial Banks will be allowed to deduct credit disbursed to 'New MSME borrowers' from their net demand and time liabilities (NDTL) for calculation of CRR.

As part of the additional measures announced by RBI Governor Shaktikanta Das after the MPC meeting, 'New MSME borrowers' have been defined as those who have not availed any credit facilities from the banking system as on January 1, 2021.

This exemption will be available for exposures up to Rs 25 lakh per borrower for credit extended up to the fortnight ending October 1, 2021.

Details of the scheme would be spelt out separately by the Reserve Bank of India.