Our Correspondent

Kohima | May 27

The 12th Nagaland Legislative Assembly (NLA) in its sixteenth (Special) session here today passed the Nagaland Goods and Services Tax Bill 2017.

Chief Minister Dr. Shürhozelie Liezietsu, who also holds the portfolio of finance, placed the bill in the House, which was later passed via a voice vote, without any opposition.

The Parliament, on April 6, had passed four legislations on the Goods and Services Tax (GST) paving the way for its rollout across the country from July 1. Most of the states in the country have already passed the state GST Bill.

According to financial memorandum introduced in the house, the GST will be a major improvement over the existing system, which among other things, would eliminate cascading effect of tax, lower production cost and prices in general, and ensure huge improvement in tax administration.

The introduction of this bill will not entail expenditure on the Consolidated Fund of the state as it can be implemented by the existing administrative set up, it added. Introducing the bill, Dr. Liezietsu said that GST regime is going to be a milestone for making the tax administration in the state making it more effective and transparent, and would have beneficial effect on the consumers and the economy as a whole.

Tax collection in the state would rise under GST regime, he said maintaining that in the event of loss of revenue, the state would be compensated for the shortfall in collection by the central government for the next five years for which the relevant act has already passed by the parliament.

Apprising the house about constitutional sanctions and subjects on which the Centre and the States can levy and collect taxes, the Chief Minister said that under the present system while there are some relief in the form of Value Added Tax (VAT) if the sale points occur be within the State, such provisions are not possible for products manufactured elsewhere.

Consequently, to reach Nagaland, the goods pass through many intermediate taxpaying sellers, located in some other state or states, leading to higher prices. Under new GST regime, the price is expected to be lower as one will be allowed to claim credit for the tax paid earlier, irrespective of the kind of indirect tax and also the place where it has been paid, he added.

The Chief Minister also informed that such a scenario will lead to avoidance of cascading effect of taxes and bring down the cost of the product or service and finally benefit the end consumer.

The system will also check tax evasion, since trade and industry will benefit by coming under the GST system through a “Self-Policing” mechanism, he pointed out adding that the process is“likely to expand and lead to more revenue collection.”

Due to the “destination principle,” where taxation is based on supply and consumption and not on manufacturing, Dr. Liezietsu said a pre-dominantly consumer state like Nagaland will benefit under GST regime. It will open new era in the indirect taxation structure and administration in India, he added.

E-billing for transparency, higher collection

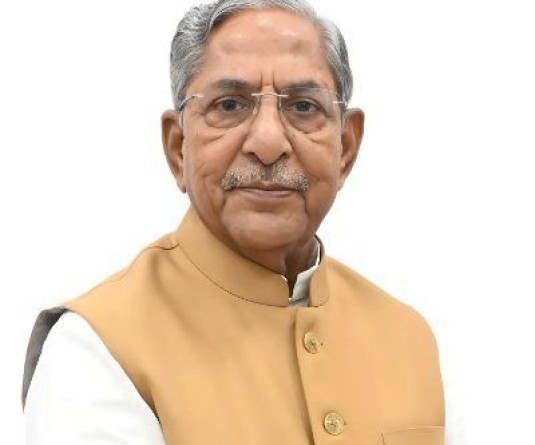

Earlier, participating in the discussion, DAN Chairman and Finance Advisor TR Zeliang called for eliminating corruption and black money through ‘technology checking’.

“E-billing ensures 100% collected taxes comes to the state exchequer instead of present 30-40%,” he said. Under the GST, all Central Sales Taxes will come to the state exchequer unlike the earlier regime when all Central Sales Taxes goes to the manufacturing state, Zeliang added.

As a result, he maintained that the revenue increase in tax collection can be expected to increase by 400-500%. To introduce e-billing and seamless connectivity, optical fibre cable (OFC) lines have been provided to all district headquarters, including four sub divisions, to solve the problem of internet connection in rural areas, Zeliang informed.

Dispelling apprehension over the introduction of the new GST regime, he appealed the people especially with small business establishment in rural areas not to panic as it “will cover only those firms with annual sale return of Rs. 10 Lakhs and above.”

Under GST, total tax payable will drastically come down to 28%, with the elimination of taxes such as toll tax, excise tax, or entry tax etc., from the present 32% ultimately benefitting the consumers to a great extent, DAN chairman further highlighted.

With all these in place, the slogan of ‘one government, one tax’ will become reality, he underscored.

‘Benami’ account

Taking part in the discussion, Minister of School Education & SCERT Yitachu draw attention to the practice of traders and business people registering themselves in the name of STs and SCs to avoid taxes.

Stating that it is depriving the state exchequer of revenue generation, he expressed hope that the GST system will check such illegal practices.

Yitachu further said that the Act East Policy will enhance the trading activities and open up opportunities for the youth, but it will fail without the active participation of the stakeholders.

“Let us create amenities and open up avenues,” he said while referring to the saturated avenues for more employment under the government.

Minister Roads & Bridges Y Vikheho Swu said that GST regime will boost production at both national and international level; cut down cost of production; and lead to cheaper prices besides the state gaining revenue.

Joining the debate, Parliamentary Secretary for Housing Er. Levi Rengma stressed the need for the state to gear up to be self sufficient and independent in revenue.

“We should start assessing our self as a mature state especially in policies of taxes,” he said and appealed the concerned departments to make the system an all e-payment system.

Nagaland is a consumer state and when we have no system of revenue generation, the GST regime will create avenues for the same, said Parliamentary Secretary for Tourism C. Apok Jamir. He also pointed out that the system will promote and inculcate professionalism in the business community. (With inputs from DIPR)

NLA adopts Govt resolution on Naga political issue

Our Correspondent

Kohima | May 27

The members of the Nagaland Legislative Assembly in the 16th (Special) Session of the 12th NLA here today unanimously reiterated its position to pave the way in the event of an honourable and amicable settlement arrived at as a result of the ongoing Naga political talks.

The House further urged the Government of India to expedite the ongoing political dialogue and bring an early resolution of the ongoing almost 20 years political dialogue before the scheduled Assembly elections in early 2018. The House unanimously adopted the government’s resolution after it was moved by Chief Minister Dr. Shürhozelie Liezietsu on the floor of the House.

If any amicable and acceptable settlement is arrived between the Government of India and the Naga political groups, then the state government will pave way for any alternate arrangement, he added.

Later, Treasuries & Accounts, Relief & Rehabilitation Advisor Dr. TM Lotha referring to the Naga political dialogue said that unless Nagas come together as one and unite,there will be setbacks for an early solution to the political dialogue.