RBI booster dose: Key rates slashed

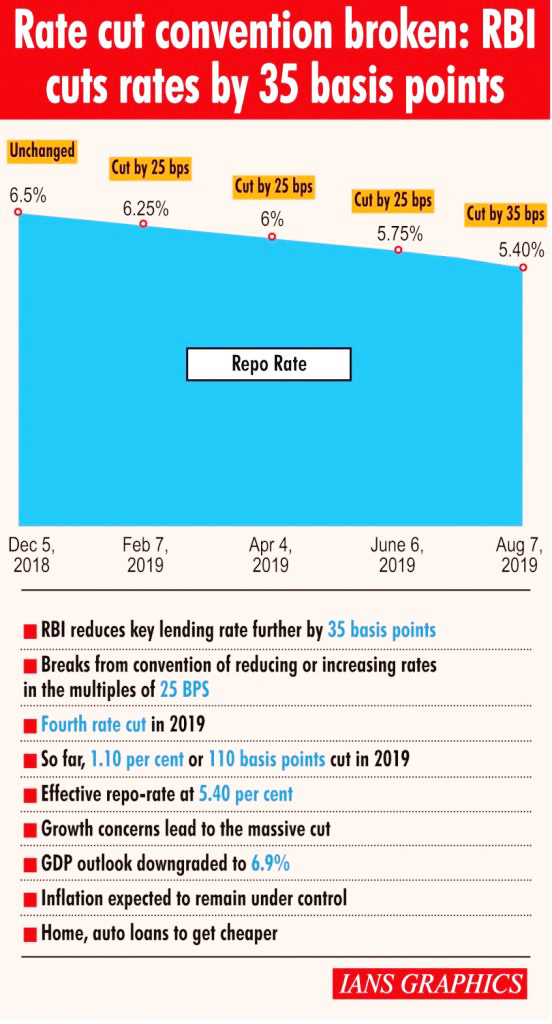

Mumbai, August 7 (IANS): To shore up slackening growth, the Reserve Bank of India on Wednesday broke with convention by reducing its key lending rates by 35 basis points which is expected to make home and auto loans cheaper and rev up the economy by unleashing consumption-led demand.

The RBI's monetary policy committee (MPC) in its third policy review of the current fiscal reduced the repo, or short-term lending rate for commercial banks, by 35 basis points to 5.40% from 5.75%. The reverse repo rate was revised to 5.15%, and the marginal standing facility (MSF) rate and the bank rate to 5.65%.

Besides reducing key lending rates for the fourth consecutive time, the MPC maintained its accommodative stance of the monetary policy. A lower repo lending rate for commercial banks, will reduce interest cost on automobile and home loans, thereby ushering in growth.

Currently, high GST tax rate, along with stagnant wages, farm distress and liquidity constraints have demoralised auto, home and capital goods buyers. Even the high frequency indicators suggested moderation in economic activity.

As per the monetary policy statement, the MPC was of the view that the standard 25 basis points reduction might prove to be inadequate in view of the evolving global and domestic macroeconomic developments. Historically, the central bank has been either reducing or increasing rates in the multiples of 25 basis points.

Cuts 2019-20 GDP growth rate to 6.9%

On the growth front, the MPC reduced its forecast to 6.9% from 7%in FY2019-20.

The GDP growth for the first quarter of FY2020-21 is projected at 7.4%.

In the June resolution, MPC had projected the real GDP growth for 2019-20 at 7% - in the range of 6.4-6.7 for H1:2019-20, and 7.2-7.5% for H2 -- with risks evenly balanced.

However, MPC said the impact of monetary policy easing since February 2019 is also expected to support economic activity, going forward.

Nonetheless, equity investors were disappointed, as there were no announcements on new measures to boost consumption.

The S&P BSE Sensex closed 286.35 points or 0.77 per cent lower at 36,690.50 points, while the NSE Nifty50 was down 92.75 points or 0.85 per cent at 10,855.50 points.