Moa Jamir

Dimapur | February 3

To say that the Government of Nagaland (GoN) has been waiting eagerly for the final report of 15th Finance Commission (XVFC)’s recommendation would be an understatement.

As a financially-crunched State, funds from the Union Government, developmental or otherwise, are crucial.

Presenting the 2020-21 State’s Budget on February 13, 2020, Chief Minister, Neiphiu Rio started his speech highlighting that the “coming financial year 2020-21 is important for the State because it marks the commencement of the Fifteenth Finance Commission Award period.”

Two Members of the XVFC – Dr Ashok Lahiri and Ajay Narayan Jha visited the State from January 8-10 in 2020 and among others, the Government of Nagaland (GoN) requested the Commission to give due “consideration in covering the revenue deficit and recommending State Specific grants to ensure that there is a minimum level of development in the State,” Rio then informed.

The GoN’s Minister in-charge, Finance further underscored that the previous XIVFC had not recommended State Specific Grants citing the increased devolution to States by 10% from 32% to 42% and that it is facing Rs 529 crore financial liabilities due to the discontinuation of Special Plan Assistance (SPA).

“We are hopeful of a favourable response from the Commission,” he noted.

The XVFC led by Chairman N K Singh had submitted its report for the period 2021-22 to 2025-26 titled, “Finance Commission in COVID Times” to the President of India on November 19, 2020.

However, it was made available in public domain only after it was tabled by the Finance Minister Nirmala Sitharaman on February 1, along with explanatory memorandum/action taken report on the recommendations therein. Earlier, an interim report for FY 2020-21 was tabled in Parliament along with Budget 2020-21.

XVFC broad recommendations

As per the terms of reference (ToR), the Commission was mandated to give its recommendations on wide-ranging issues for five years from 2021-22 to 2025-26. Distribution of proceedings from taxes called divisible pool, revenue deficit and other grants, however, are major components.

The foremost task is deciding how the percentage of net proceeds of taxes (after deducting cesses and surcharges & cost of collection) be distributed between the Union and the States, or vertical devolution.

Regarding this, the XIVFC stuck with the previous Commission (FCXIV) recommendations of 42% share in the divisible tax pool during the period 2021-22 to 2025-26.

However, it made an adjustment of about 1% due to the changed status of the erstwhile State of Jammu and Kashmir into the new Union Territories of Ladakh and Jammu and Kashmir and maintained the States’ share in the divisible pool of taxes to 41% for the five-year period starting 2021-22.

After determining the States’ aggregate share in the divisible pool, the other task was deciding shares of each state based on certain parameters called horizontal devolution.

For horizontal devolution, the formula based on principles of need, equity and performance, overall devolution formula were Population (15%); Area (15.%); Forest & Ecology (10%), Income Distance (45%), Tax & Fiscal Efforts (2.5%) and Demographic Performance (12.5%).

Next, the Commission recommended revenue deficit grants of Rs. 2,94,514 crore over award period (2021-22 to 2025-26) for seventeen States - Andhra Pradesh, Assam, Haryana, Himachal Pradesh, Karnataka, Kerala, Manipur, Meghalaya, Mizoram, Nagaland, Punjab, Rajasthan, Sikkim, Tamil Nadu, Tripura, Uttarakhand and West Bengal. A total of Rs 74,340 crore has already been sanctioned for the same purpose to fourteen States in 2020-21.

The Government has accepted those recommendations of the Commission.

What’s in it for Nagaland?

In comparison to the XIVFC, there was a slight increase for Nagaland in terms of ‘Share in Central Taxes & Duties’ in XVFC.

According the “Total Transfers” recommended by XVFC, during the award period, Nagaland’s ‘Share in Central Taxes & Duties for the period 2021-26 is estimated to be Rs 24,039 crore or 0.569% of the divisible pool of taxes, up from Rs 20379 crore in 2015-20 or by 16.47.

During the last Commission period, the State’s share was 0.498%.

Additionally, the Post Devolution Revenue Deficit for the State is recommended to be Rs 21,249 crore during the award period signifying a 13.966% increase from last Commission. This would give the State a breathing room in terms of revenue.

During the last Commission’s award for the period 2015-20, the Grants-in-aid for Revenue Deficit for Nagaland was Rs 18,475 crore.

The Commission noted that the GoN had recommended 25% of the total devolution to the States be set aside for Special Category States as against 11.53% allocated by the FC-XIV.

Again, it suggested that out of 25% of the total devolution to the States, 3% each be allocated to States like Nagaland which have geopolitical significance.

A preliminary reading of the XVFC’s report indicated that these recommendations were not taken into context.

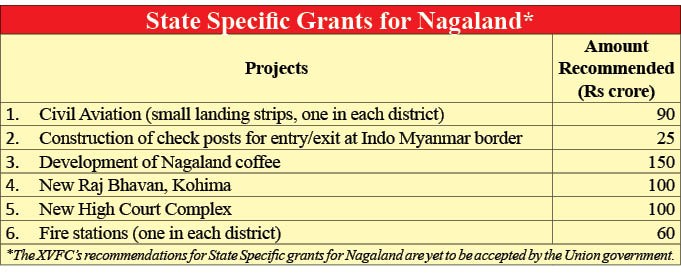

However, the XVFC recommended for some State Specific Grants for Nagaland with projects worth Rs 525 crore. (See table)

Overall, the total transfers for Nagaland XVFC, including grant for local governments, health, PMGSY etc are given as Rs 47,812 crore during the award period.

Due to the reduction in Plan grants to these States, total Central transfers as a percentage of GSDP declined in five NEH States (in percentage points) – Manipur, Mizoram, Nagaland, Sikkim, Tripura.

.jpg)