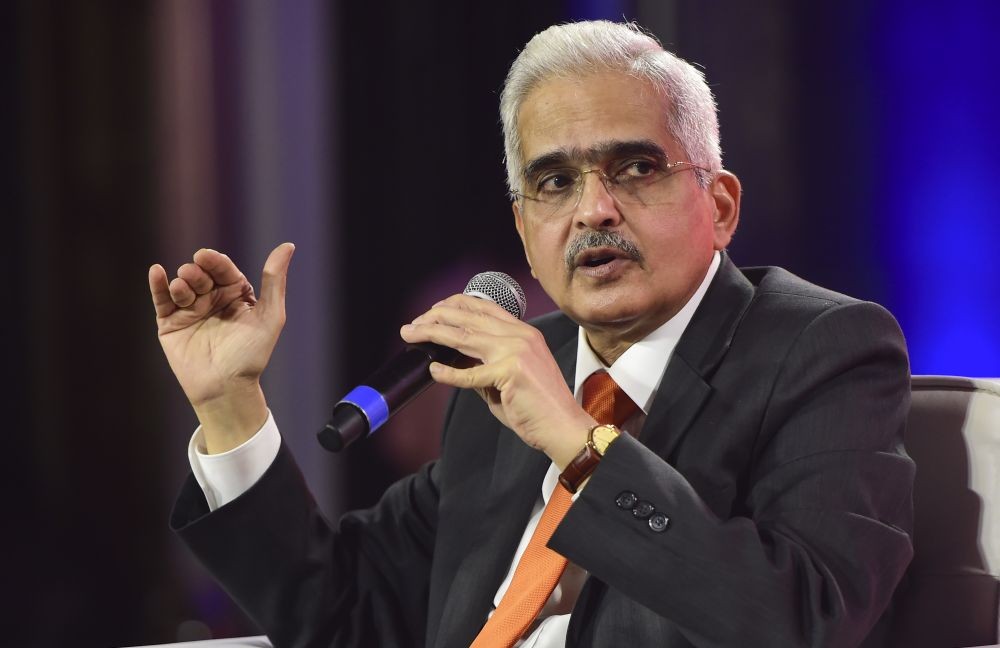

New Delhi, June 13 (IANS) Reserve Bank of India (RBI) Governor Shaktikanta Das on Tuesday expressed confidence that India will be among fastest growing economies in the world in 2023 which would grow at the rate of 6.5 per cent in the current fiscal.

"We expect real GDP to grow by 6.5 per cent during 2023-24. In all likelihood, India will remain among the fastest growing large economies in 2023," the RBI Governor said while delivering the opening plenary address at the Summer Meetings organised by Central Banking in London.

He said that the Indian economy displayed "exemplary resilience" post-pandemic and rebounded strongly from a contraction of 5.8 per cent in 2020-21 to a growth of 9.1 per cent in 2021-22 and 7.2 per cent in 2022-23, as proactive and coordinated response of fiscal and monetary policies nurtured a quick recovery.

He said that various structural reforms related to banking, digitalisation, taxation, manufacturing and labour, implemented in the last few years, laid the foundation for strong and sustainable growth over the medium and long term.

"The government's continued thrust on capital expenditure is creating additional capacity and nurturing the much-awaited revival in the corporate investment," he said.

The Indian economy has also made rapid gains in openness and has gradually integrated with the global economy over the years, Das asserted.

"Consequently, it is getting increasingly exposed to the vagaries of global headwinds. It is, however, pertinent to note that India's growth in the last few years is mainly driven by robust domestic demand, especially private consumption and investment, amidst the global slowdown," he noted.

The RBI Governor further said that being proactive and nimble footed during a crisis gives one the agility to respond speedily to evolving developments that are overwhelming.

"In this regard, our decisions at the height of the coronavirus crisis in 2020 and our liquidity rebalancing measures in 2021 served us well. Second, our measures have been prudent, targeted and calibrated to the need of the hour.

"We have not been tied down by any existing dogma or orthodoxy. While lowering the floor of the interest rate corridor and increasing its width, we did not inject excessive liquidity or dilute our collateral standards. We kept in mind that what is being rolled out needs to be rolled back in time and in a non-disruptive manner," he said.

"Third, we backed up our monetary policy actions by appropriate regulatory and supervisory measures, including macro-prudential instruments, that reinforced the policy impact and its credibility."

"Fourth, we provided guidance and confidence to the market and the wider public through effective communication as part of our endeavour to anchor expectations and sentiments appropriately. Thus, communication became an additional pillar of our overall policy response during the pandemic," Das elaborated.