Lhusisato Iralu

Advocate

The recent notification issued by the State Government on 28.04.2020 levying COVID-19 Cess on diesel at Rs 5/litre and petrol at Rs 6/litre has invited astute criticisms from various civil society organizations, political parties and trade bodies in our State, imploring the concerned authorities to rollback the levy imposed. While the demand of these bodies is genuine, this article seeks to legally analyze the manner in which the COVID-19 Cess (hereinafter referred to as ‘the COVID Cess’) has been imposed, and whether the COVID Cess could have been levied under the relevant statutory provision, i.e., The Nagaland (Sales of Petroleum and Petroleum Products including Motor Spirit and Lubricants) Taxation Act, 1967 (hereinafter referred to as ‘the 1967 Act’ for brevity).

Meaning of Cess

Article 270(1) of the Constitution of India refers to Cess as being levied for a specific purpose. Clause (28) of article 366 provides the definition of taxation, which is as follows – “taxation,” includes the imposition of any tax or impost, whether general or local or special, and “tax” shall be construed accordingly. Thus, a Cess is a form of taxation and the word ‘tax’ includes a Cess. The amount collected from a Cess can also only be used for that specific purpose and not for any other purpose. The Hon’ble Supreme Court in Union of India & Anr v Mohit Mineral Private Limited [(2019) 2 SCC 599], after referring to three of its earlier decisions, held that the expression “Cess” means a tax levied for some special purpose, which may be levied as an increment to an existing tax.

Taxing Provision

The Union or State’s power to tax its citizens is strictly guided and controlled by article 265 of the Constitution which provides that no tax shall be levied or collected except by authority of law. The expression ‘authority of law’ occurring in article 265 has been summed up the Supreme Court in Saurashtra Cement & Chemical Industries Ltd v Union of India [(2001) 1 SCC 91] to mean a valid law, which means the tax proposed to be levied must be within the legislative competence of the Legislature imposing the tax, and the tax must be authorized by such valid law; law here means the Act of the legislature and not any isolated rule issued by the executive. The taxing law also permits the legislature to delegate its functions to the executive provided the delegation is expressly made with a specific authorization and is not exCessive.

State’s Act

In view of the above legal position, any Cess that the State seeks to impose on its citizens must be qualified by a valid Act of the Legislature and/or there must be a specific authorization conferred on the executive by a valid statute to impose the Cess.

Coming to the relevant 1967 Act prevailing in our State, the said Act has undergone various amendments over the past years. However, with the 101st amendment of the Constitution of India in 2016 and the subsequent enactment of the Nagaland Goods and Services Tax (GST) Act, 2017, the 1967 Act has been partly repealed by the Nagaland GST Act, 2017, in the manner as stated hereafter. By the 101st Constitutional amendment, the old entry 54 under List II (State List) occurring in the Seventh Schedule was substituted by the new entry 54 to include taxes on the sale of petroleum crude, high speed diesel, motor spirit (commonly known as petrol), natural gas, aviation fuel turbine and alcoholic liquor for human consumption. Consequently, by section 174 (1) of the Nagaland GST Act, 2017, the 1967 Act was partly repealed except in respect of goods included in the new entry 54 of the State List. The corollary of this partial repeal is that taxation of goods like kerosene, lubricants, Liquefied Petroleum Gas (LPG) and other petroleum products, which were earlier taxed under the 1967 Act, now falls within the ambit of the Nagaland GST Act, 2017. Thus, insofar as motor spirit (petrol) and high speed diesel (diesel) are concerned, i.e., the two goods relevant for the purpose of this article, the statutory provisions of taxation contained in the 1967 Act still stands as of today.

State’s Tax

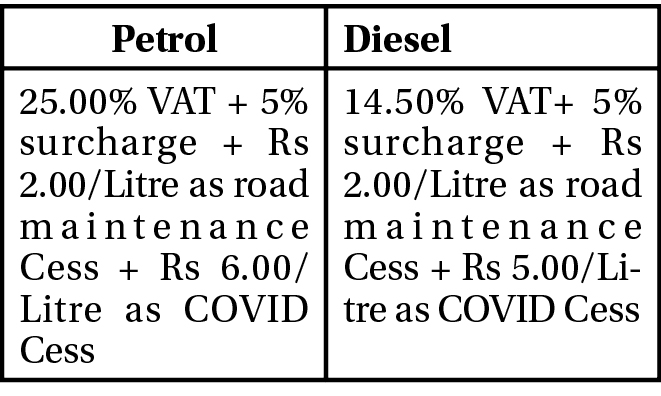

As per the data available as on 01.05.2020 on the website of Petroleum Planning & Analysis Cell, which falls under Ministry of Petroleum & Natural Gas, GOI, the State of Nagaland imposes the following taxes on petrol and diesel –

The above data roughly translates to around Rs 22-23/litre for petrol and Rs 14-15/litre for diesel being taxed by the Government of Nagaland which goes into the coffer of the State. The remaining price composition of petrol/diesel is divided between the base price, Centre’s excise duty and dealer’s commission, which ultimately results in the final RSP (Retail Selling Price).

Definitions in the 1967 Act

Section 2(10) defines “taxable goods” to mean such goods as are specified in Schedule-II to the Act, and section 2(10B) defines “tax” to mean the tax payable under the Act, which is the tax on sale.

Sections 3(1) & 3A(3)

The relevant sections for the purpose of this article, i.e., section 3(1) and section 3A(3), of the Act may be appreciated below –

“3. Incidence of tax on sale – Subject to the other provisions of this Act, with effect from such date as the State Government may, by notification in the official Gazette, appoint,

(1) Every dealer –

(i) Who imports into Nagaland, or

(ii) Manufactures or produces goods specified in Schedule-II shall be liable to pay tax on his turnover of sales with effect from the day on which he effects his first sale of such goods.

3A(3) The State Government may by notification in the Official Gazette add to or omit any entry or entries in Schedule-II or modify or vary the rate or rates of tax specified therein and thereupon the said entry or entries in the rate or rates of tax shall be deemed to have been amended accordingly.

Provided that the Government shall not fix the rate of tax, in any case, exceeding thirty paise in a rupee.”

The provision for levying surcharge has been specified under section 3B of the Act, which is separate from and an increment to the sales tax. Further, Schedule-II specifies the rate of tax on sale of petrol, diesel and other products under entry 54 of the State List. The proviso to section 3A(3) further adds the maximum rate of tax on sale which cannot exceed thirty paise in a rupee or 30% per entry. Emphasis may also be laid on the heading contained in section 3 of the 1967 Act which implies that the tax which the State is authorized to levy is tax on the sale of goods. It is under this statutory framework that the State imposes sales tax on petrol and diesel.

Preamble of the 1967 Act

To further gather the intention of the State Legislature in enacting the 1967 Act, the Preamble to the said Act may also be taken into consideration –

“Preamble – WHEREAS it is expedient to repeal the Assam (Sales of Petroleum and Petroleum Products including Motor Spirit and Lubricants) Taxation Act, 1956 (Assam Act IX of 1956) and to re-enact one to impose tax on sales of Petroleum and Petroleum Products, including Motor Spirit, Lubricants, Diesel Oil and Crude Oil for the purpose of making an addition to the public revenue;”

I would again like to lay emphasis on the type of tax that the Legislature intended to levy, which is tax on the sales of goods, with the objective to make an addition to the public revenue. The revenue so generated can be used for any purpose which the State deems fit.

Legal Flaws

In this backdrop, I propose to build a case as to why, given the clear statutory provisions, the State could not have imposed the COVID Cess, or any other Cess for that matter, by exercising power under section 3A(3) of the 1967 Act, as has been done by the notification dated 28.04.2020.

1. A plain reading of the 1967 Act, according to me, leads to the inevitable conclusion that the language contained therein is unambiguous and does not authorize the executive to impose Cess on its citizens. The word “Cess” is not even found in the 1967 Act. The only power authorized by section 3A(3) of the 1967 Act on the executive is to add or omit the entries in Schedule II or modify or vary the rate or rates of tax. Section 3A(3) does not speak about addition of another tax to Schedule II. By reading the definition of ‘tax’ under section 2(10B), the content of section 3 and the Preamble of the Act as a whole, the phrase “modify or vary the rate or rates of tax” as appearing in section 3A(3) can only mean “modifying or varying the rate of tax on sales or sales tax”, and not the addition of another tax by way of Cess. In other words, the modification pertains only to the rate and not the tax. Cess, as stated above, is not a part of sales tax but a separate taxing entity which is to be levied for a specific purpose as an increment to the existing tax.

Now, I do not mean to imply that the State cannot impose a Cess, but in order to do so the strict provision of article 265 read with article 270(1) and the law laid down by the Hon’ble Supreme Court has to be adhered to. The Constitution Bench of the Supreme Court in Madhuram Agarwal v State of Madhya Pradesh [(1999) 8 SCC 667] held that "the intention of the legislature in a taxation statute is to be gathered from the language of the provisions particularly where the language is plain and unambiguous. In a taxing Act it is not possible to assume any intention or governing purpose of the statute more than what is stated in the plain language….Equally impermissible is an interpretation which does not follow from the plain, unambiguous language of the statute. Words cannot be added to or substituted so as to give a meaning to the statute which will serve the spirit and intention of the legislature. The statute should clearly and unambiguously convey the three components of the tax law i.e. the subject of the tax, the person who is liable to pay tax and the rate at which the tax is to be paid. If there is any ambiguity regarding any of these ingredients in a taxation statute then there is no tax in law.” Therefore, it is submitted that in the absence of a specific and unambiguous provision in the 1967 Act authorizing the executive to levy a Cess, including the rate at which it is to be levied, the COVID Cess, in its present form, is invalid.

2. To supplement the above submission, it will also be observed that the 1967 Act does not lay down any standard for guidance or a limit for permissible delegation or a legislative policy for the executive to levy Cess. Therefore, the exercise of power by the State under section 3A(3) of the Act is violative of the dictum laid down by the Constitution Bench of the Supreme Court in Kishan Prakash Sharma & Ors v Union of India & Ors [(2001) 5 SCC 212].

3. Considering, however, the above points or submissions as being fallacious and assuming the executive, indeed, has been authorized to levy Cess as per section 3A(3) of the 1967 Act, the State still has to show that the delegation of such power is not exCessive. In order to do that, the above point 1 and 2 needs to be disproved with clear and cogent evidence without adding or substituting any word to the 1967 Act.

Conclusion

Therefore, according to my reading, the imposition of COVID-19 Cess, or any other Cess, by virtue of section 3A(3) of the 1967 Act is a legal flaw for being ultra vires the 1967 Act and violative of article 265 of the Constitution of India.

Views are personal only