Moa Jamir

Dimapur | September 19

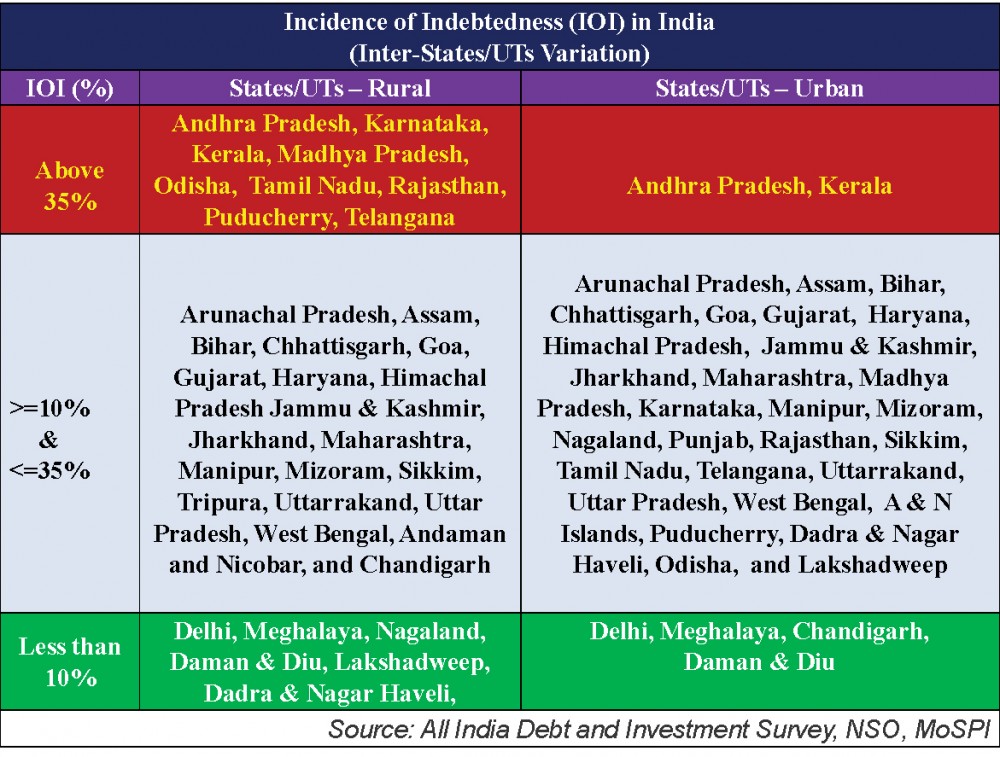

The incidence of indebtedness (IOI), or the percentage of the indebted households in rural Nagaland is among the lowest in India, but access to credits from institutional agencies are very low, revealed a new survey by the National Statistical Office (NSO).

Even in the context of urban areas, households with IOI was just 10.1%, informed the latest ‘All India Debt & Investment Survey 2019’, conducted by the NSO under the Union Ministry of Statistics and Programme Implementation (MoSPI) during the period January – December, 2019 as a part of 77th round of National Sample Survey (NSS).

Prior to this the survey was carried out in NSS 26th round (1971-72), 37th round (1981-82), 48th round (1992), 59th round (2003) and 70th round (2013), the Ministry stated while releasing the survey on September 10.

Minimal indebtedness in rural Nagaland

As per the survey, Nagaland was among 6 States or Union Territories (UTs) where the IOI in rural households was less than 10%. The other States/UTs were Delhi, Meghalaya, Daman & Diu, Lakshadweep, Dadra & Nagar Haveli.

Overall, the survey noted that the rural IOI in Nagaland was just 6.5% of the total households, comprising of cultivator as well as non- cultivator.

The percentage was fourth lowest in India after Delhi (3.1%), Lakshadweep (4.4), and Dadra & Nagar Haveli (6%). The all-India ratio was 35.0%.

In addition, the IOI among the cultivator was also low in Nagaland at 6.4 against national average of 40.3% while among non-cultivator, the IOI was 7.5% against all-India average of 28.2%.

The highest IOI, according to the survey, was prevailing in Andhra Pradesh, Karnataka, Kerala, Madhya Pradesh, Odisha, Tamil Nadu, Rajasthan, Puducherry, and Telangana in rural area with over 35% while in the context of urban population, it was highest in Andhra Pradesh and Kerala.

Relatively higher IOI in urban households

The scenario, however, was bit different in the case of urban sector with Nagaland slotted among those States or UTs with indebtedness ranging 10%-35%.

Specifically, however, IOI among urban household was 10.1% in Nagaland, against national average of 22.4%.

Category-wise, in the rural household, the IOI among self employed was 15.0 and 8.6% for others. The corresponding national averages were 27.5% and 20.6% respectively.

Low institutional credits

While indebtedness was relatively low in Nagaland for both rural and urban households, the survey revealed that access to credit via institutional agencies like banks, post offices, co-operative etc for various purposes was concerning.

For instance, among those household in rural areas having debts, maximum percentage of borrowing was non-institutional (4.2%) while just 2.2% was institutional and 0.1% of both.

Further, among the cultivators, out of 6.4% of households having IOI, only 1.8% were availing the same from formal financial institutions while 4.6% were getting informally, possibly at a high rate of interest for their loans. A total of 0.1% was availing was availing both.

Across India, maximum debts were from institutional agencies (17.8%) against 10.2% non-institutional and &% of both.

Among non-cultivators in Nagaland, IOI by credits agencies were 4.5 % institutional, 2.8% non-institutional and 0.3% of both.

In the urban household, however, credits via institutional agencies in Nagaland were higher at 5.1% against non-institutional agencies at 3.8%. Those availing both were 1.3%.

Accordingly, while only 24 per 1000 rural households were reporting cash debt, 18 of them were in the form of compound interest, while 5 were paying simple interest. Only family was shown as getting the ‘interest free.’ In urban households, out of 64 per 1000, 45 were in ‘compound’ while 18 were simple.

In India, a total of 248 per 1000 rural households reported cash debt, the category of debts were equally divided between simple and compound interest (123 each) while 9 households were availing the credits interest free.

The NSO’s All India Debt & Investment Survey, thus, revealed a need to augment institutional access to credits particularly in rural areas of Nagaland.