Our Correspondent

Kohima | February 15

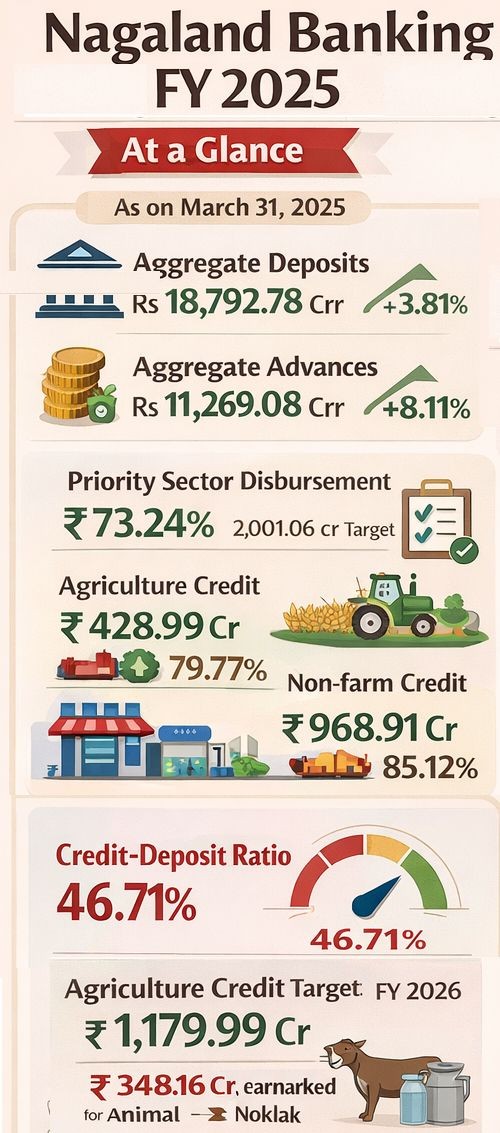

Deposits and advances in Nagaland recorded growth of 3.81% and 8.11%, respectively, during the financial year (FY) ending March 2025, according to the State Focus Paper (SFP) 2026–27 released by the National Bank for Agriculture and Rural Development (NABARD), Nagaland Regional Office, Dimapur.

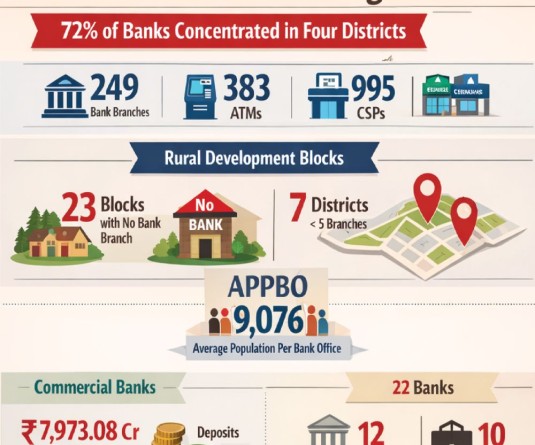

The SFP outlined key developments in the State’s banking and credit sector during FY 2025. Aggregate deposits increased from Rs 18,102.62 crore as on March 31, 2024 to Rs 18,792.78 crore as on March 31, 2025, reflecting a growth of 3.81%. Aggregate advances rose from Rs 10,423.47 crore to Rs 11,269.08 crore during the same period, marking an 8.11% increase.

As per State Level Bankers’ Committee (SLBC) data, advances to agriculture accounted for 24.33% of total advances, while total priority sector advances constituted 66.13%, both exceeding the minimum national stipulations of 18% and 40%, respectively. Advances to the MSME sector stood at 36.57%, while other priority sector advances accounted for 5.39%.

The overall Credit-Deposit (CD) ratio stood at 46.71% as on March 31, 2025, lower than the previous financial year. Two banks — Federal Bank and Yes Bank — continued to record CD ratios below 20%, the SFP noted.

Priority sector advances (66.13%), agriculture advances (24.33%), and weaker section lending (40.57%) remained above national norms of 40%, 18%, and 10%, respectively.

However, against the Annual Credit Plan target of Rs 2,001.06 crore for priority sector advances in FY 2025, total disbursements stood at Rs 1,465.56 crore, achieving 73.24% of the target. Agriculture credit during FY 2025 amounted to Rs 428.99 crore, achieving 79.77%, while the non-farm sector recorded disbursements of Rs 968.91 crore, achieving 85.12%.

The SFP stated that credit plays a crucial role in providing working capital and encouraging investment in agriculture. NABARD prepares annual credit plans estimating aggregate credit potential across rural sectors based on district-level Potential Linked Credit Plans, following a bottom-up approach that reflects ground realities.

For FY 2026, the agriculture credit target has been fixed at Rs 1,179.99 crore. To provide focused support to allied activities, a separate credit flow target of Rs 348.16 crore has been earmarked for Animal Husbandry, Dairy and Fisheries.

The report also noted that disbursements during FY 2025 increased by Rs 298.95 crore over the previous year in absolute terms. Crop loan disbursement stood at Rs 245.10 crore against a target of Rs 220.13 crore, recording an increase of 133.16% over the previous year’s achievement.

Performance under the “other priority sector” stood at 20.75% of target in FY 2025 compared to 49.15% in FY 2024. Agency-wise analysis showed that Public Commercial Banks achieved 86.45% of their lending targets, Private Commercial Banks achieved 65.43%, while Nagaland State Cooperative Bank Ltd and Nagaland Rural Bank achieved 37.31% and 32.90%, respectively.

District-wise, Dimapur and Mokokchung accounted for the largest shares of agriculture credit disbursed at 18.75% and 14.73%, respectively. Shamator recorded the lowest share at 0.60% (Rs 2.59 crore), followed by Noklak at 0.80% (Rs 3.47 crore).