Morung Express News

Dimapur | July 26

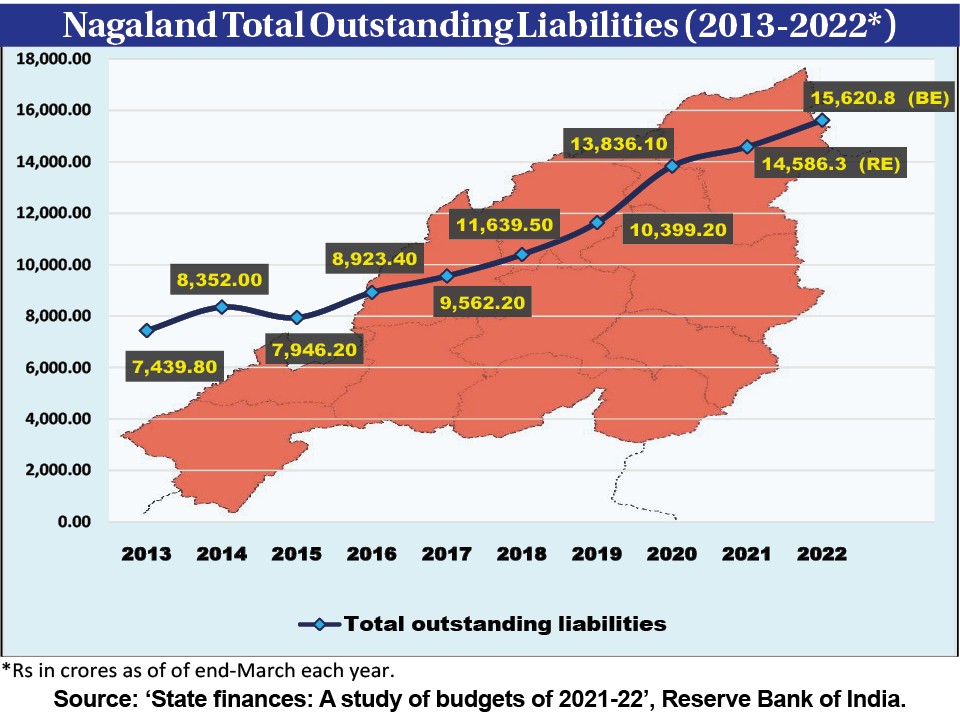

The total outstanding liabilities (debt) of Nagaland Government have been gradually increasing and stood at Rs 15,620.8 crore as of March 2022, informed data provided by the Union Finance Minister, Nirmala Sitharaman in the Lok Sabha on July 25. The figure was the advance budget estimate and may be revised further.

As per the State-wise details of total outstanding liabilities of State Governments cited by the Minister in a reply to a starred question in the Lower House, the actual debt of Nagaland Government at the end of March 2020 was Rs 13,836.1 crore. This further increased by over 5% to Rs 14,586.3 crore as per the revised estimate of the financial year ending March 2021.

It further increased by over 7% to Rs 15,620.8 crore in March 2022.

Meanwhile, as per the Finance Ministry data based on ‘State finances: A study of budgets of 2021-22’ report by the RBI (Reserve Bank of India), the State of Tamil Nadu had the highest outstanding liabilities on March 2022 at Rs 6,59,868.9 crore, followed by Uttar Pradesh (Rs 6,53,307.5 crore) and Maharashtra (Rs 6,08,999.7 crore).

Among the North-East State, Assam had the highest outstanding liabilities at Rs 1,07,719.5 crore while Tripura was on the second at Rs 23,624.5 crore. Nagaland was third among the NE States.

As per the Union Budget 2022-23, the outstanding internal and external debt and other liabilities of the Government of India at the end of 2022-2023 was estimated Rs 152,17,910.29 crore, as against Rs 135,87,893.16 crore at the end of 2021-2022 (RE).

It must be noted here that the financial health as well as the debt burden of a state is determined by the debt-to-GSDP ratio, or an indicator of how much a state produces (Gross State Domestic Product (GSDP)) and how much it owes.

Therefore, a state showing high outstanding liabilities in terms of absolute numbers, may have low debt burden if its GSDP is high, and vice-versa.

As per the Nagaland Budget 2022-23, the revised estimate of the total outstanding liabilities as percentage of GSDP was 38.98, and expected to rise to 39.28 in 2022-23. (BE)

Meanwhile, detailed analysis of the RBI report further informed that the Nagaland State’s outstanding liabilities have been constantly increasing over the years and doubled over the decade.

For instance, it was just Rs 6,749.6 crore in March 2012, but a decade after in 2022, it was Rs 15,620.8 crore, indicating a 131.43% increase.

On the steps taken by the Government of India to control increasing debts of the states, Sitharaman informed that all states have “enacted their Fiscal Responsibility and Budget Management (FRBM) Act.”

Compliance to the State FRBM Act is monitored by the respective State Legislatures, she said.

The Department of Expenditure, Ministry of Finance generally follows the fiscal limits mandated by the accepted recommendations of the Finance Commission while exercising the powers to approve borrowings by States under Article 293 (3) of the Constitution of India, she added.

The normal Net Borrowing Ceiling (NBC) of each State is fixed by the Union Government in the beginning of each financial year while adjustments for the over-borrowing by States during previous years, if any, are made in the borrowing limits of subsequent year.