Morung Express News

Dimapur | February 18

Nagaland’s total outstanding liabilities or debt during the current financial year is estimated to rise further to Rs 16,562.4 crore at the end March 2023, according to a recent report by the Reserve Bank of India.

This translates to 44.2% of the Nagaland’s Gross State Domestic Product (GSDP), informed the data provided the Union Minister of State (MoS) in the Ministry of Finance, Pankaj Chaudhary in a written reply to a question in the Lok Sabha on February 13.

Accordingly, Nagaland was the third most indebted States/Union Territories (UTs) in India. Mizoram was at the top with estimated debt-to-GSDP ratio of 53.1% by end of March 2023, followed by Punjab at 47.61%.

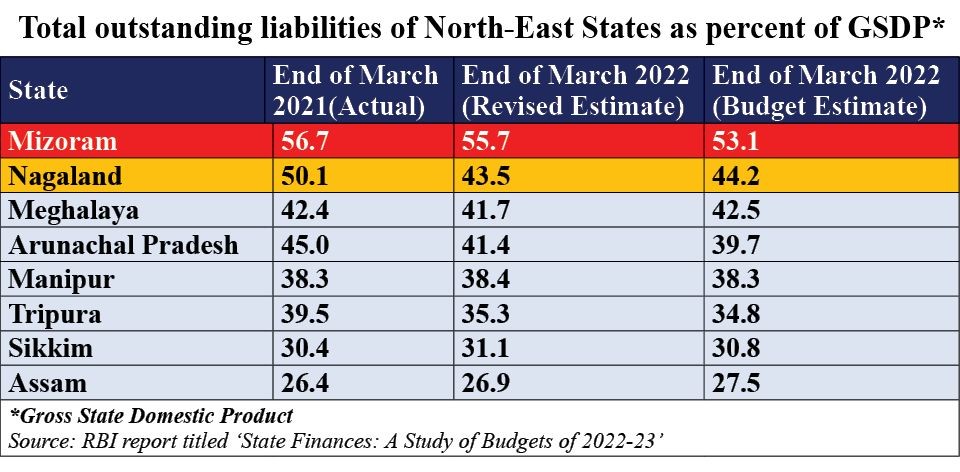

Meanwhile, citing the RBI’s report titled ‘State Finances: A Study of Budgets of 2022-23,’ the Chaudhary’s reply further informed that the revised estimate (RE) of Nagaland’s debt as of March-end 2022 was 43.5%.

The actual total outstanding liabilities of the State at the end of March 2021 were pegged at 50.1% of the GSDP.

Further analysis of the RBI report informed that in absolute terms, the debt at March-end 2022 stood at Rs 15,059.6 (RE) crore, which is expected to surge to Rs 16,562.4 crore by March 2023.

The actual total outstanding liabilities of Rs 15,254 crore at the end of March 2021 was 50.1% of GSDP, indicating some improvement in revenue collection thereafter.

According to the RBI, the outstanding liabilities comprised of Internal Debt such a Market Loans, Special Securities Issued to National Small Savings Fund (NSSF), Loans from Banks and Financial Institutions; Loans and Advances from the Centre; Contingency Fund; and Public Account such as State Provident Fund etc, Reserve Funds and Deposits & Advances.

Of the total outstanding liabilities of Rs 16,562.4 crore for Nagaland at the end March 2023, Rs 12,278.4 crore or 74.13% was designated as internal debt, implying that the State is borrowing more from market, and other financial institutions.

Debt-to-GSDP ratio of NE States

Meanwhile, the data provided by the MoS informed that most States in the North East have high total outstanding liabilities vis-à-vis their GSDP with Mizoram and Nagaland first and third nationally.

Meghalaya was next with debt-to-GSDP ratio of 42.5%, followed by Arunachal Pradesh (39.7%), Manipur (39.3%) and Tripura (34.8%).

Sikkim and Assam had lower debt to GSDP ratio at 30.8% and 27.5% respectively.

Of all States/UTs with legislature, the National Capital Territory (NCT) of Delhi had the lowest total outstanding liabilities at just 2.2% of the GSDP. Odisha and Maharashtra had the second and third lowest debt-to-GSDP ratio at 15.7% and 19% respectively.

As per the MoS, all States/UTs have enacted their Fiscal Responsibility and Budget Management (FRBM) Act and compliance to the State FRBM Act is monitored by the respective Legislatures.