New Delhi, May 29 (IANS) Niti Aayog has recommended to the Finance Ministry the setting up of a National Trade Network (NTN) on the lines of GSTN to facilitate import and exports and flagged negative interventions at the field level where customs officers raise irrelevant queries without accountability and sometimes, even rent seeking.

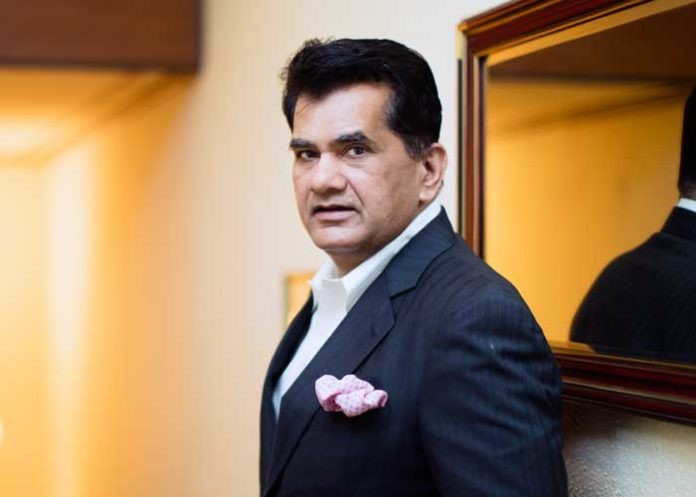

In a letter, Amitabh Kant, CEO, Niti Aayog, has suggested to Revenue Secretary Ajay Bhushan Pandey to propose further changes in customs, including improving information flow and making customs processes and IT systems more efficient.

Kant has said in the letter that the time has come to set up the NTN on the lines of GSTN integrating all departmental data flows into one integrated system.

He added that this will not only facilitate exports and imports by existing firms but will also bring in a large number of MSMEs who today have to export through the export houses and third parties on account of the complexities in the current system.

This will also radically reduce the cost of transaction and make India a highly efficient country.

It has also sought modification of the Risk Management System (RMS) to record/reflect actions of field officers.

The Niti Aayog has flagged enormous negative intervention at the field level. "Customs field authorities are legally or otherwise vested with enormous powers to raise irrelevant queries with no accountability. To avoid delay and harassment, trade agrees to speed money", it said.

At many ports, particularly at small ones, including in the hinterland, officers randomly ask Custom House Agent (CHAs) to open consignment. Customs has not introduced a serial number based physical examination system clearly mentioning that unless the same is given to exporters or his agent, consignment will not be allowed to be opened by their field officers. Percentage of shipments undergoing physical examination is still very high. While officially RMS cleared shipments are not physically inspected, customs officers might still require a 'physical check' for a variety of reasons.

"This results in delays (officer has to be first identified/deployed and then physically travel to where the goods are being held), discretion (once there, there is no guaranteeing what documents or even physical inspection the officer might want to do), and rent-seeking", it pointed out.

"Even in the absence of rent seeking, officers often demand cars/free meals/other personalized services that brokers/CFS operators have to provide to ensure presence of officers on location, and expeditiously undertaking their job", it was pointed out.

Customs uses a sophisticated Risk Management System or RMS. But many times, Customs officers have reasons to reject the RMS recommendations and go for inspection of the goods. The basis of decision making must be entered into the system, and available under the RTI with adequate anonymisation of individual shipments and their consignees, along with figures indicating to what extent in percentage terms the over-ride led to an actual finding of non-compliance.

Customs may use this data for developing analytics tools that will further reduce RMS over-ride by establishing guidelines for officers for making such decisions, it has recommended.

Niti Aayog has also sought to reduce cartelization between shipping lines and others. Cartelized behaviour between shipping lines and their agents, CFS operators (and in some case terminal operators) and freight forwarders/brokers often results in padding up of bills and firms are made to pay for unnecessary charges. In many cases, firms are forced to use certain services or certain facilities (such as a specific CFS or ICD) and have no choice in the matter.

Since many large shipping lines have a freight forwarding business as well (and by extension also in the brokerage business), such behaviour becomes even more rampant.

Any random check of invoices would show that there is marked deviation from published rates due to large number of 'operational variations' and 'situational exceptions'. While such variations and exceptions are a common feature for logistics services that have to adjust dynamic and unpredictable operational needs and environment, this also provides an opportunity to unscrupulous players to 'game' the system.

The important recommendation to set up a National Trade Network (NTN) is to enable all export-import related compliance online.

The NTN will allow exporters to file all information/documents online at one place; there will be no need to deal with customs, DGFT, shipping companies, sea and airports, and banks separately.

The inbuilt system intelligence will route the required information to the appropriate agencies. Centralised submission, assessment and processing will minimise the need for posting of large numbers of officers at the local customs house, central excise or DGFT offices.

Today, over 80 per cent of officers doing trade-related jobs are posted in the local offices. These officers process applications or carry out assessment of cases relating to a designated office. Shortage of staff impacts the output at many places.

With NTN, while officers may continue to be located in different locations physically, they will be available to assess files submitted anywhere in the country. A service agreement will bind all organisations to respond within 2-5 hours, and enable users to receive permissions online, Niti Aayog said.

Among the customs reforms recommended is to improve the information flow. The first task is to use simple language and ensure transparency in issuance of notifications.

"It is impossible for a layman (and often for individual with expertise, including the CBIC officials) to actually figure which rules, procedures and regulations are extant for specific types of trade situations. The 'paper' mess has simply been digitised", the recommendations said.

"For example, notifying import duty is a crucial task of Customs. Yet, finding correct customs duty for a product is a pain. You need an expert to wade through the maze of hundreds of customs notifications issued every year. The notifications are not self-contained and amend part of an earlier notification issued years ago", the recommendations said.