SBI held its one-day town hall meeting on customer experience enhancement at Hotel Saramati, Dimapur on November 26. (Morung Photo)

Morung Express News

Dimapur | November 26

A one-day State Bank of India (SBI) ‘Town hall meeting on customer experience enhancement’ was organised at Hotel Saramati, conference hall on November 26. The event was held with intent to share concerns and provide awareness to customers against cyber fraudsters.

Speaking on ‘Digital banking safety measures,’ Hrailu Duh Poumai, Chief Manager, Dimapur Bazaar Branch highlighted on the advantages and disadvantages on using third-party cash transaction apps.

He said that while applications such as Google Pay and the like are convenient to use, these are not authorized by the Reserve Bank of India (RBI) with no proper helpdesks available for when a transaction fails. When it comes to YONO SBI however, he mentioned that the banks are responsible for any issue faced by the customer. “If your issue is not resolved within seven days, the bank is liable to give compensation,” he stated.

With the increase in the number of smart phone users across the country, Poumai noted that there has been an increase in online scams and frauds. Among these scams include digital arrests, juice jacking courier scams, KYC scam, money transfer fraud, fake loan fraud among others.

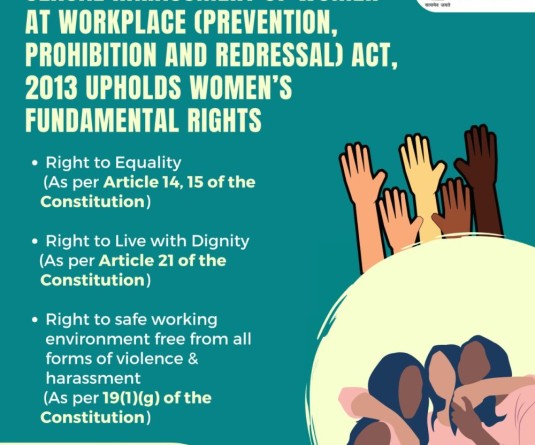

As such, he advised the customers to use their toll free number 18001234 for any queries or complaints related to the bank. On the topic of ‘Customer Rights, grievance redressal and compensation policy,’ Poumai mentioned that there are several different rights made available to them.

He also stressed on the importance of providing customer feedbacks through any modes such as through YONO app, official website or in any ATM bank so that the bank can enhance and work upon their services in the long run.

David Nengsinlian Naulak, Chief Manager, Dimapur Branch speaking on ‘New initiatives taken by SBI to improve customer experience,’ meanwhile announced the recent introduction of WhatsApp banking through an individual’s registered mobile number. In addition, he said the bank has rolled out he decease accounts settlement claim process, reduction in OTP length from 8 to 6 digits, nomination facility through non-home branch, virtual debit cards, YONO lite among others.

A feedback and suggestions session for customers was also held during the event where customers shared on issues faced by pensioners, schemes or loans for self help groups, consumer services etc.

Earlier, the welcome address was delivered by Hriipunii Alpha Pou, Chief Manager (operations), RBO Dimapur who noted that this is being held across the country.

SBI has over the years introduced various initiatives and this event is intended to bridge such gaps so that we have better understanding with our customers, he said.