Image Source: IANS News

By Sreejith Balasubramanian

IANS | February 3

Most of us awaited Indias Union Budget 2021-22 for its fiscal policy strategy to support growth, as the economy slowly emerges from the pandemic. Given previous episodes of shortfalls in realized receipts and rising off-budget expenditure, one was also ready to calculate more likely receipts and the true fiscal deficit. As mentioned in our previous note (link), the budget was a pleasant surprise as it estimated tax revenue conservatively, unlike recent years and vs. expectations this year. It also took a firm step towards reducing the rising off-budget financing, and has started repaying corresponding dues, by directly funding these through the government balance sheet. This enhances transparency but has also increased the budget size well beyond most of our estimates.

The other theme which stood out was the thrust on capital expenditure (capex) in FY21 and FY22, the best option now within counter-cyclical spending, given its higher growth multiplier (vs. revenue expenditure) through the job creation and private participation it draws. We look at the impact of the government balance sheet clean up in detail, states' fiscal position and role in capex, conservative revenue estimates and its implications. Further, being at the juncture when generating sustainable, inclusive and higher growth is vital, various measures of adjusted expenditure and capex imply the growth impulse of this budget could be lower than what the headline numbers suggest. This makes execution all the more critical, with implications also for the fiscal glide path envisaged and thus sovereign debt sustainability.

Food (subsidy) on a cleaner plate

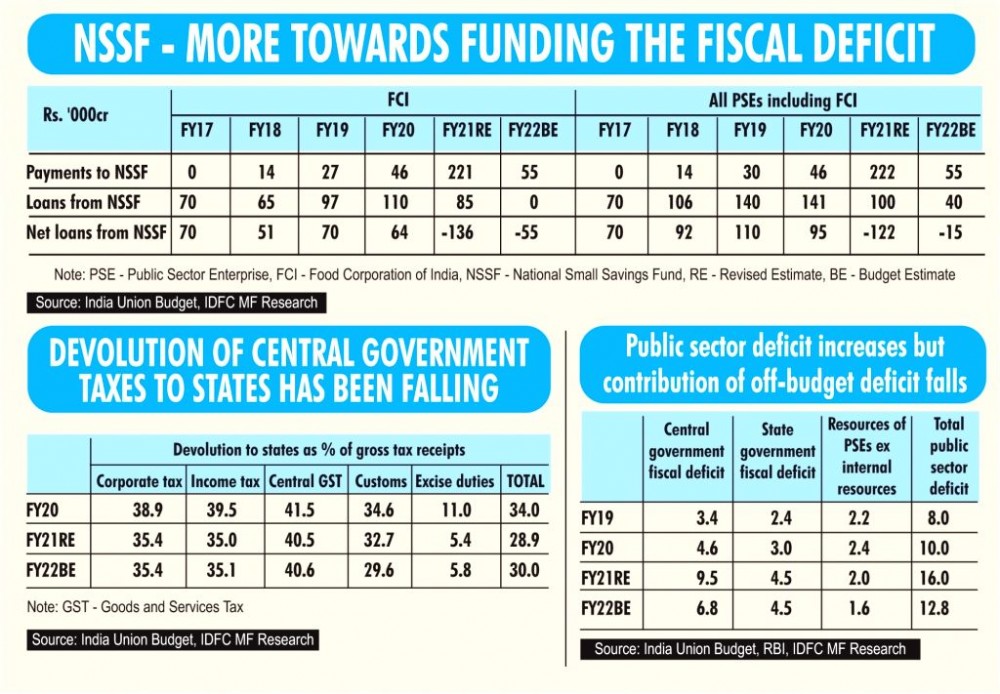

Government expenditure on food subsidy towards the FCI was being partially funded through loans from NSSF to FCI, since FY17. This arrangement reduced the government's fiscal deficit and did not increase its debt. The government has now taken food subsidy on its budget, utilising its cash surplus. It plans to start repaying the outstanding dues to NSSF from this year and fully stop the NSSF funding to FCI from next year. Firstly, FCI will repay NSSF Rs. 2.2 lakh crore in FY21 and Rs. 55,000cr in FY22, using government funds, thus freeing up NSSF space for financing the fiscal deficit. Further, food subsidy this year is higher (Rs. 2.87 lakh crore funded through budget and NSSF), owing to the additional food grains distributed as part of the government's response to the Covid crisis. These are revealed as higher on-budget food subsidy - Rs. 4.2 lakh crore in FY21 (vs. BE of Rs. 1.6 lakh crore) and Rs. 2.4 lakh crore in FY22. After this, food subsidy incurred by FCI in FY23 should fall back to Rs. 1.8-2.0 lakh crore but the subsidy number on the budget would most likely also include the final repayment of Rs. 64,000cr which FCI would owe NSSF at the end of FY22. NSSF would also need to be repaid another Rs. 1.7 lakh crore, its outstanding dues at end-FY22 from all other PSEs ex-FCI it funded.

Funding of the food subsidy has thus been rationalised but the subsidy amount itself is getting quite high. This year's Economic Survey suggested a consideration of the revision of the Central Issue Price, given rising food security needs could make it difficult to reduce volumes. However, even this could practically prove difficult.

Another Extra Budgetary Resource (EBR) mobilisation was through the Government Fully Serviced bonds (FSBs), which was used to fund schemes under various Ministries, and did not impact the government's fiscal deficit and debt. This funding route is also planned to be stopped in FY22 from 0.3% of Gross Domestic Product (GDP) in FY19 and 0.2% in FY21. Public Sector Bank (PSB) recapitalisation bonds, which impact only the government debt and not the fiscal deficit, are still active although its usage has fallen from 0.6% of GDP in FY19 to 0.1% each in FY21 and FY22.

Nudging the states for capex

Devolution to states, from the gross tax revenue collected by the central government, is down from 37% in FY19. This has fallen across tax categories but is primarily due to the higher excise duties and cesses collected which are not fully shareable with states. Devolution is estimated to be 28.9% in FY21, with equal offsetting adjustments for excess given to states in FY20 and deficit due to them in FY19, after which it is budgeted to increase marginally to 30% in FY22. However, given conservative tax revenue estimates by the central government for FY21 and FY22, there could potentially be an upside to devolution from better tax buoyancy. Any additional amount for FY21 would likely be received only in FY22. Similarly, any excess devolution for FY22 will depend on the tax buoyancy then, but the amount received in FY22 would also depend on the centre's FY22RE calculation next year.

Transfer to states (ex-loans given in lieu of the GST shortfall of Rs. 1.1 lakh crore in FY21, which is separate from devolution, is also budgeted to rise Rs. 69,000cr y/y in FY22, of which revenue deficit grants will be up Rs. 44,000cr. States have been provided a normal net borrowing limit of 4% of GDP for FY22, but a part of it will be tagged towards incremental capex, with another 0.5% of GDP to be conditional. While this could nudge states in the right direction, the feasibility of specific targets and its acceptability by various states will have to be seen. States account for ~60% of total annual capex and was expected to fund 39% (same as the Centre) of the National Infrastructure Pipeline (NIP) as at end-2019.

Conservative revenue estimates - a good problem?

On tax revenue estimates, even the FY21RE numbers appear very conservative. This is because it implies gross tax collection during Jan21 to Mar21 to contract 10% y/y, at a time when it has started picking up strongly (33% y/y in the Dec20 quarter). For reference, even if we assume full year FY21RE tax collection grows only at the %y/y rate seen during the Apr20-Dec20 period (which would be low due to weak collection early on), and accept the government's high expenditure estimate, FY21 fiscal deficit would be lower from the government's estimate by Rs. 85,000cr or 0.4% of GDP. The cyclical recovery likely underway, delinking witnessed between mobility and Covid cases, sequentially better demand as the economy reopens and vaccination progresses and higher tax compliance (e.g. for GST) would be the driving factors. However, for now, this implies lower tax devolution to states based on FY21RE.

It wouldn't have been a surprise if the government had assumed a slightly higher tax buoyancy in FY22, given it tends to undershoot growth in a recessionary year and then overshoot in the recovery year. However, the overall gross tax revenue is estimated to grow 16.7% y/y, only slightly above the 14.4% nominal GDP growth estimated which itself carries an upside risk. This provides the much needed space to accommodate a shortfall in other receipts or higher expenditure or maybe even settle for a slightly lower fiscal deficit as deemed fit later.

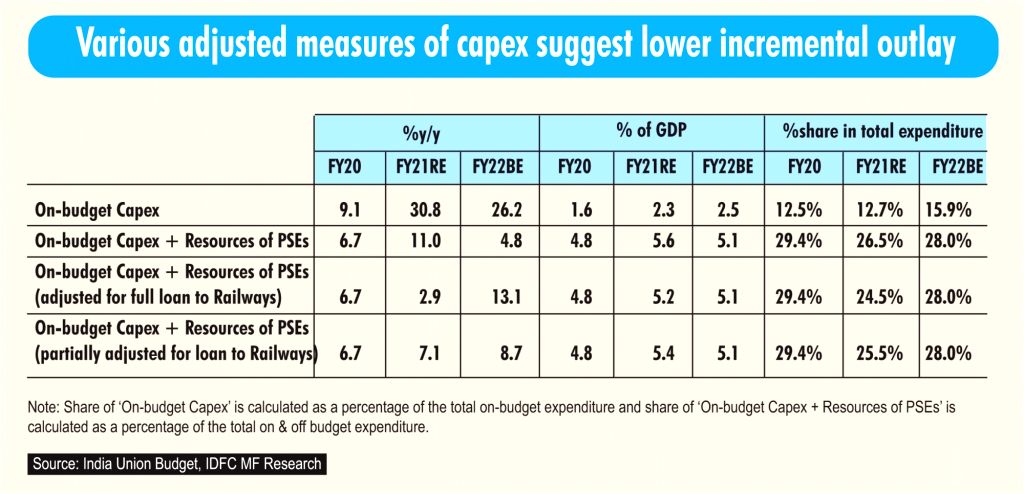

Capex thrust - details imply lower growth impulse

Total public sector deficit rises in FY21 (80% of which is due to rise in centre's fiscal deficit from the clean-up) and falls in FY22, but it stays well above FY20 levels. Of this, resources of PSEs ex-internal resources fall from 2.4% of GDP in FY20 to 1.6% in FY22. This is fully classified as off-budget capex and the drop in FY22 is mainly driven by the fall in food subsidy funding and support to Railways, while resources towards power, steel, petroleum and natural gas ministries have actually risen. Thus, consolidated capex (total on and off budget) stays flat from FY21BE to FY21RE as the higher capex on budget is offset by lower capex off budget. However, this has brought more capex on budget and increased transparency. Further, it increases only 4.8% y/y in FY22 vs. the 26% increase in on-budget capex. This implies the overall capex and thus the impulse to growth it provides is lower on a consolidated basis. In terms of the quality of the mix of spending, share of on-budget capex in on-budget expenditure rises sharply in FY22 to well above pre-Covid (FY20) levels but, on a consolidated basis, the rise is lesser in FY22 and is estimated to be below the pre-Covid share which itself was falling since FY19.

The government has provided a special Loan of Rs. 79,398cr to the Railways in FY21, which is included in its capex, for Covid related resource gap in FY21 and to liquidate adverse balance in Public Account in FY20. One could strip this from the FY21 capex number. However, it can also be argued that there has been a drop in the Railway's budgetary support (capital expenditure for the Centre) by Rs. 41,000 from FY21BE to FY21RE, which is more than offset by the special loan and thus only the additional portion of the loan (Rs. 38,398cr) should be stripped. We see consolidated capex growth in FY21 further dropping in these scenarios. Similarly, one can also deduct the expenditure clearly understood to be non-capex in nature, from the off-budget capex headline number (e.g. food subsidy component), but this may not be consistently comprehensive.

Implications beyond FY22 - fiscal glide path and debt sustainability

FY22 fiscal deficit falls sharply as expenditure through the budget is estimated to grow only 1% y/y and revenue recovers from Covid-hit FY21. After FY22, further consolidation would be more gradual as seen from the fiscal glide path itself. So, to get to a fiscal deficit of below 4.5% of GDP by FY26, we will need growth to keep receipts buoyant and/or expenditure management. So, 1) timely and effective execution of incremental capex using the NIP (42% of identified projects was already under implementation as at end-2019) is vital so that maximum growth multiplier kicks in and lifts medium term growth beyond FY22, 2) asset monetisation and disinvestment strategies have to continue beyond the 1-2 year horizon and 3) expenditure optimisation would also matter as private sector spending slowly kicks in with the public sector capex push, cyclical recovery and Production Linked Incentive (PLI) schemes. The Economic Survey cites research on how counter-cyclical public spending in developing economies can actually crowd in private investments, through the utilisation of unused resources, employment creation and expansion of the savings pool available for funding. However, given the economy's experience post the 2008 crisis and with the 2013 taper tantrum, it would be reasonable to expect macroeconomic parameters, like the current account deficit, and its thresholds to be guiding factors in optimizing fiscal policy.

Further, India's primary deficit (fiscal deficit ex-interest payments) falls only to 3.1% of GDP in FY22 from 5.9% in FY21. While it could be slightly better, given current tax assumptions are conservative, it would still be well above the average of 0.4% from FY17-FY19. It is to be seen how the government exactly views debt sustainability. While the RBI's latest Financial Stability Report flagged the increase of sovereign debt, to levels that raise concerns about sustainability and crowd out the private sector in terms of volume and cost of borrowing, the Economic Survey argued India's sovereign debt will remain sustainable even at high primary deficits, given nominal growth is expected to stay above the nominal borrowing cost.