Our Correspondent

Kohima | March 12

The State Focus Paper (SFP) 2023-24 for Nagaland was presented recently by the National Bank for Agriculture and Rural Development (NABARD) with an assessed credit potential of Rs. 1015.59 Crore under priority sector activities for the year 2023-24.

“The focus of banks during the year 2023-24 should be in saturating the potential gap with Kisan Credit Cards (KCCs) with special focus on animal husbandry, fishery and PM Kisan beneficiaries and operationalizing the Agriculture Infrastructure Fund (AIF) in Nagaland, “ stated Tiakala Ao, general manager /OIC, NABARD Nagaland Regional Office in foreword of the SFP.

She stated that financing of Farmers Producers Organizations (FPO) including those promoted under the central sector scheme for formation of 10,000 FPOs in the state should also be targeted. The state needs to focus on agriculture including expanding irrigation facilities, horticulture and food processing, which can revolutionize the state’s economy, she stated, adding “our credit planning exercises has factored in these priorities."

The SFP, which was released by R. Binchilo Thong, Agriculture Production Commissioner in Kohima last week, presents potentials for various priority sectors in the state, highlights the constraints in various inputs for development, identifies critical gaps in infrastructure and provides suggestions for improvement, thus attempting to provide a complete perspective for development planning for the state for the Financial Year 2023-24.

Financial Inclusion

As of March 31, 2022, 1,21,123 people have been enrolled under the PM Jeevan Jyoti Bima Yojana, the SFP stated.

Similarly, 3,68,649 persons have been covered under the PM Suraksha Bima Yojana. 21,506 persons have been covered under Atal Pension Yojana. The total number of accounts under PM Jan Dhan Yojana stood at 3,45,049 as on March 31, 2022.

As of March 31, 2022, 11 banks have 274 Banking Correspondents / Customer Service Points in rural areas of Nagaland.

Direct Benefit Transfer (DBT) has been successfully rolled out in Nagaland with Aadhaar seeding and authentication. As of December 31, 2022; there are 49 banked blocks in Nagaland leaving 25 blocks unbanked.

Farm Credit

The SFP stated that agriculture in the state is the largest employer with more than 60% of the workforce engaged in the sector.

The potential for credit support assessed for Farm credit (both crop loan & term loans) for the year 2023-24 is Rs. 466.16 crore.

Issue of Kisan Credit Cards (KCCs) for crop loans, Animal Husbandry and Fishery activities will further boost farm credit, the SFP observed.

Considering the importance of agriculture and allied sector in increasing income, employment and achieving inclusive growth, it is imperative to increase investment in the sector, especially keeping in view the GoI's aim of doubling farmers' income, the SFP stated.

Storage godowns and market yards

The SFP informed that making available scientific storage facilities has been one of the critical requirements to ensure remunerative prices to farmers and reduce losses on account of improper storage and distress sale.

There is scope for development of godowns, cold storages and ripening chambers in private sector through bank loan.

The potential for credit support assessed for Storage Godowns / Market Yards for 2023-24 is Rs.12.64 crore, it stated.

Implementation of the Agriculture Infrastructure Fund (AIF) is expected to give a boost to this sub sector under agriculture, it observed.

Land Development

Stating that natural resources management is a basic requirement for improving productivity, the SFP maintained that NABARD, under its watershed development programmes, supports treatment of arable land for enhancing its productive capacities.

The potential available for the Land development, soil Conservation and Watershed development sector for 2023-24 has been estimated at Rs. 25.8 crore.

Food and Agro Processing

The SFP maintained that food and agro processing plays a significant role in increasing value addition in agriculture and horticultural produce, diversification and commercialization of agriculture, reduction in wastage of farm produce, generating employment opportunities and enhancing export earnings.

Variety and quantity of crops produced in the state offers a vast potential for agro-processing activity in the state.

The potential assessed for lending to agro processing units, for 2023-24 is Rs. 16.77 crore. Implementation of the PM Scheme for Formalization of Micro Food Processing Enterprises (PMFME) through Directorate of Industries & Commerce (DIC), Government of Nagaland will further boost this sunrise sector in the state, it noted.

Rural Infrastructure Development Fund

The main objective of the RIDF is to provide loans at a concessional rate of interest to State Government and State-owned corporations to enable them to create rural infrastructures.

Since inception of RIDF in 1995-96, cumulatively, 11 hydro power projects, 57 minor irrigation projects, 321 soil conservation projects and 294 agri & allied projects, have been sanctioned to the State Government.

Further, to develop infrastructure for rural connectivity in the State, NABARD has sanctioned 443 road and bridge projects for creation of rural road networks and bridges connecting remote parts of the state, the SFP informed.

Micro, Small and Medium Enterprises

The revision in MSME guidelines by RBI has removed the distinction between manufacturing and service industries from this year.

Bank loan to Startups up to Rs. 50 crore has been included under this priority sector head.

“There is good potential for supporting micro enterprises under MUDRA particularly working capital requirements of small traders,” the SFP stated.

A credit flow projection of Rs. 311.84 has been assessed for MSME sector during 2023-24. Timely sanction of loans, Common Facility Centres, promotion of ancillary would further boost development of MSME sector in the state.

Spring-shed based Watershed Development

The SFP also noted that due to adverse impact of climate change in recent years, the springs, which are lifeline of the North Eastern Region (NER), are getting dried up affecting agriculture and livelihood of rural community.

In order to revive and rejuvenate these springs and minimize the adverse impact of climate change on water availability both for human consumption and irrigation, especially during off-season, NABARD has launched an innovative and integrated springshed-based participatory watershed development programme in the NER, including Sikkim, on a pilot basis with financial support under WDF since January 2017.

In Nagaland, a total of 23 projects-18 under PIP and 5 under PPIP, each covering a maximum treatment area of 300 ha have been sanctioned.

Tribal Development Programmes

The SFP informed that that NABARD has been closely associated with tribal development and sustainable livelihoods.

As an integral component of NABARD's Natural Resource Management (NRM) policy of providing sustainable livelihoods, NABARD laid special emphasis on providing support for holistic development of tribal communities with orchard establishment as the core element. In this direction, NABARD has created a Tribal Development Fund (TDF).

Under TDF, NABARD has sanctioned a total of 16 projects in the state with a total grant assistance commitment of Rs. 2598.16 lakh and soft loan assistance of Rs.75.00 lakh, covering 5,750 rural households in 18 RD blocks through livelihood interventions like plantation crops, soil and water conservation measures, etc.

The orchard based livelihood development programme has paved the way for sustainable livelihood of the beneficiary families, the SFP maintained.

Informal Credit Delivery System

As of March 31, 2022 for the year 2021-22, 1,372 SHGs were credit linked for a loan amount of Rs 25.93 crore, it stated, adding that the total loan outstanding was Rs. 49.03 crore against 3275 SHGs (Source : SLBC).

Under JLG financing in Nagaland, as of March 31, 2022 for the year 2021-22, 176 JLGs were extended loan amount of Rs. 6.45 crore by various banks. The total loan outstanding was Rs. 19.86 crore against 1318 JLGs (Source: SLBC).

NABARD is supporting livelihood interventions through conduct of Micro Enterprise Development Programmes (MEDPs), Livelihood Enterprise Development Programmes (LEDP) and marketing interventions like Rural Mart and sponsoring marketing events.

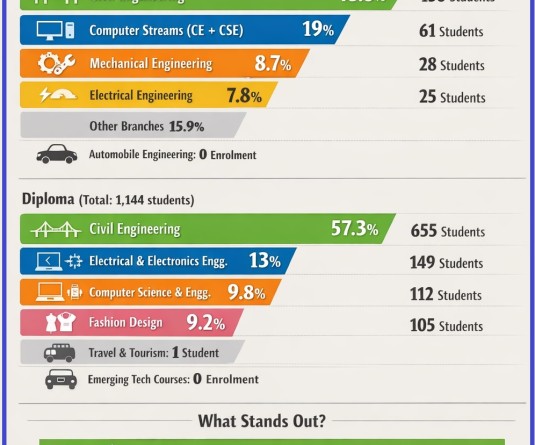

Skill India Scheme

Pradhan Mantri Kaushal Vikas Yojana (PMKVY), the flagship scheme of the Ministry of Skill Development & Entrepreneurship (MSDE), GoI is running in the State.

NABARD also supports skilling and other off-farm activities through its Gramya Vikas Nidhi (GVN).

Under GVN, NABARD sponsored different skill course like tailoring, house painting, banana fibre extraction etc which were conducted in different districts of the state.

As of March 31, 2022, NABARD has sanctioned 15 Skill Development Programmes in the State, which has helped in training more than 500 unemployed rural youths with a total financial support of Rs. 18.34 lakh.

Way Forward

• State Government may explore for enhancing public investment for creation of rural infrastructure.

• Banks need to improve their credit delivery by covering more farmers under KCC which is still very low in the state.

• Banks may explore financing in potential areas where rural infrastructure/sectoral developments have been created by the Government.

• Promotion of value addition of various farm and off-farm products of the state.

• Sufficient labour force with requisite skills is required from within the state.

• GI tagging and Organic Certification should be taken up to cover as many products and areas of the state as possible.