Our Correspondent

Kohima | May 1

The Nagaland Government today stated that the COVID-19 pandemic will have devastating impact on the State's economy.

Additional Chief Secretary and Finance Commissioner Sentiyanger Imchen today disclosed that there is a huge gap in the expected and projected revenue shortfall for the State based on the latest central government reciepts.

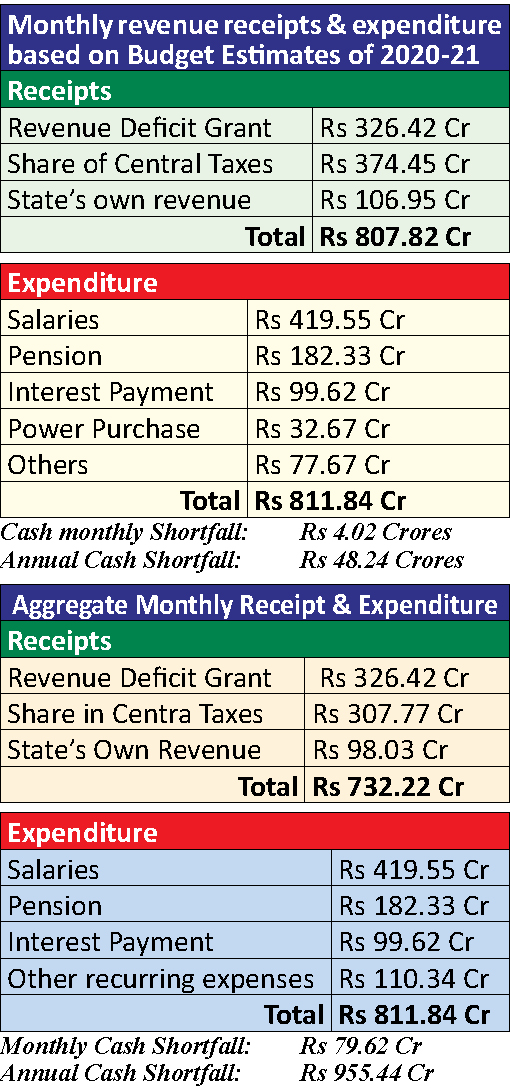

The cash shortfall per month which was expected to be about Rs 4.02 Crores is now projected to be Rs 79.62 Crores. The yearly cash shortfall for the State has also seen an increased projection of Rs 955.44 Crores from the expected Rs 48.24 Crores. (See Tables)

Addressing a press conference today, Imchen said that this negative impact on the State's revenue is a result of reduction of central tax shares as well as increase in expenditure due to the pandemic. This negative impact is expected to be felt over the coming months.

Imchen informed that the Chief Minister has already written a letter to the Prime Minister on this. The letter contained the projections regarding revenue deficits for the State of Nagaland, based on receipts for the month of April from the Central Government.

Based on this actual position emerging, it is clear that the shortfall in the coming months may be higher than what we have initially anticipated, said the Finance Commissioner.

He said that the COVID-19 pandemic will also leave the Government with no choice but to allocate more funds for health infrastructure and other related areas which have not been budgeted, leading to increase in the levels of deficit.

He informed that the State Government has taken preemptive steps such as a freeze on all fresh appointments, freeze on DA/DR in line with the central government's decision, cut on non-development expenditure including ban on purchase of vehicles and possible pro-rata cuts on developmental expenditure.

COVID-19 cess expected to generate Rs 55.58 Crores anually

The Finance Commissioner also informed that the government has taken steps to augment the revenues of the state by increasing the rate of tax on petroleum products in the form of COVID-19 cess.

This is expected to generate additional revenue of Rs 55.58 crore annually, he said.

He said that the specific mention of COVID-19 in the cess has been done to ensure utilization of the revenue generated for COVID-19 pandemic related activities.

“This cess would be withdrawn once the threat of the COVID-19 pandemic is formally declared to be over,” said Imchen.

He clarified that though the price of international crude oil has come down over the past weeks, the benefit of this reduction has not been passed on to the consumers by the Central Government.

Clarifies on funds released for COVID-19 activities

The Finance Commissioner also clarified on the amount of funds released to the State to fight the COVID-19 pandemic.

He reiterated the Finance Department's clarification that the amount of Rs. 326.42 crore claimed to have been released for COVID-19 related activities is actually the amount released by the Central Government as Revenue Deficit Grant.

Meanwhile the amount of Rs. 20.50 crore was released for the State Disaster Relief Fund as recommended by the 15th Finance Commission.

He informed that the actual amounts released by the Central Government so far for COVID-19 related activities include Rs 3 Crores by the NEC, and Rs 7.42 Crores by the Government of India. Further, an amount of Rs. 20.50 Crores has also been released as first installment of SDRF for 2020-21. From this, a maximum of 35% can be used for COVID-19 related activities.