Post office officials with awardees and others during the observance of Postal Life Insurance Day held in Kohima on October 12. (Morung Photo)

Our Correspondent

Kohima | October 12

As part of National Postal Week and celebration of Azadi Ka Amrit Mahotsav @ 75, Nagaland Postal Division today observed Postal Life Insurance Day here at Kohima Head Office premises.

Speaking on the occasion, Daniel Domeh, Divisional System Administrator, Nagaland Division said that Postal Life Insurance (PLI) was introduced on 1st February, 1884.

It started as a welfare scheme for the benefit of postal employees and was later extended to the employees of the Telegraph department in 1888.

In 1894, PLI extended insurance cover to female employees of the erstwhile P & T Department at a time when no other insurance company covered female lives.

“It is the oldest life insurer in this country,” said Domeh.

Rural Postal Life Insurance

With the increasing need and demand for insurance scheme in the rural areas, Rural Postal Life Insurance (RPLI) was introduced on March 24, 1995 to extend the Life Insurance scheme to the people engaged in unorganized sector in the rural areas. He said that Postal Life insurance is all about a sound financial position of an individual or family, adding that it builds a financial corpus with low premium and high bonus. “It also gives you the benefit of Income Tax rebate under the section 80C of Income Tax Act 1961,” he said.

He said that PLI offers six types of policies. It includes; Whole Life Assurance (Suraksha), Endowment Assurance (Santosh), Convertible Whole Life Assurance (Suvidha), Anticipated Endowment Assurance (Sumangal), Joint Life Assurance (Yugal Suraksha) and Children Policy(Bal Jeevan Bima).

Whole Life Assurance

This is a scheme where the assured amount with accrued bonus is payable to the insured either on attaining the age of 80 years, or to his/her legal representatives or assignees on death of the insured, whichever occurs earlier, provided the policy is in force on the date of claim.

This scheme features Minimum & Maximum age at entry: 19-55 years. Minimum Sum Assured Rs. 20,000; Maximum Rs. 50 lac, loan facility after 4 years, premium paying age can be opted for as 55,58 or 60 years.

Endowment Assurance

Under this scheme, the proponent is given an assurance to the extent of the sum assured and accrued bonus till he/she attains the pre- determined age of maturity i.e 35,40,45,50,55,58 & 60 years of age.

In case of death of insurant, assignee, nominee or legal heir is paid full amount of sum assured with accrued bonus.

Minimum & maximum age at entry: 19-55 years, Minimum sum assured Rs. 20,000; Maximum Rs. 50 lac, Loan facility after 3 years, last declared Bonus – Rs. 52 per Rs. 1000 sum assured per year.

Convertible Whole Life Assurance

A Whole Life Assurance Policy with the added feature of an option to convert to Endowment Assurance Policy at the end of five years of taking policy. It offers assurance to the extent of sum assured with accrued bonus till attainment of maturity age. In case of death, assignee, nominee or legal heir paid full amount of sum assured with accrued bonus

Anticipated Endowment Assurance

It is a Money Back Policy with maximum sum assured of Rs. 50 lakhs. It is best suited to those who need periodical returns. Survival benefits are paid to the insurant periodically.

The policy term is 15 years and 20 years. 15 years Policy- 20% each on completion of 6 years, 9 years & 12 years and 40% with accrued bonus on maturity 20 years Policy- 20% each on completion of 8 years, 12 years & 16 years and 40% with accrued bonus on maturity.

Joint Life Assurance

It is a Joint Life Endowment Assurance in which one of the spouses should be eligible for PLI policies.

Minimum term of policy stands 5 years and maximum 20 years

Children Policy

This scheme provides life insurance cover to children of policy holders. Maximum two children of policy holder (parent) are eligible. Children between 5- 20 years of age are eligible. Policy holder (parent) should not be over 45 years of age. No premium to be paid on the Children Policy, on the death of policy holder (parent). No medical examination of child necessary. However, child should be healthy and risk shall start from day of acceptance of proposal

Earlier, the programme was chaired by Kevikhrielie Kirha while welcome address was delivered by Joy Justin Bongcher, Assistant Superintendent of Posts Office Kohima Sub Division. Vote of thanks was proposed by Kevilekho Angami. The occasion also witnessed screening of video on Azadi Ka Amrit Mahotsav India @75.

Awards for outstanding performances for procurement of PLI/RPLI

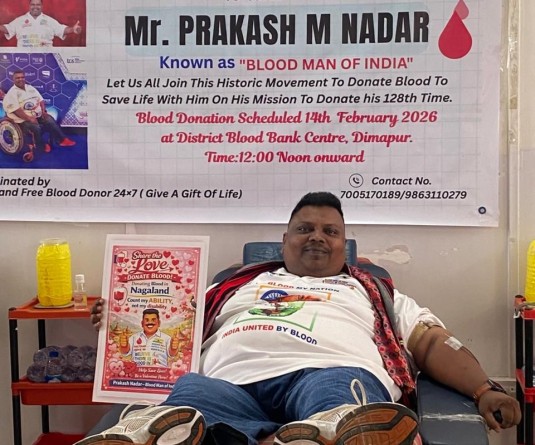

The occasion witnessed award of officials for their outstanding performances for procurement of PLI/RPLI during the period April- September 2021.

Awardees under Procurement of PLI New business/ Departmental Employee: 1st - L Imtikumzuk, 2nd – Nokpangnenla, Gramin Dak Sewak – 1st- Rahul Paul, 2nd- Kum Videtonu Phinyo, Direct Agents – 1st- Kum Lorhevonu, 2nd- Kum Kikrusetono Caroline Nisa.

Under procurement of RPLI new business/Departmental Employee: 1st- Hovika Zhimomi, 22nd- K Amongla Ao, Gramin Dak Sewak – 1st- Rahul Paul, 2nd- Dilip Kumar, Direct Agent – 1st- K Hankiumong Yimchunger, 2nd- Kum Reguizeule Ndang.

Further, two officials- Imkongtula Imchen and L Imtikumzuk have also been awarded at the North East Circle level for their outstanding performance in procurement of PLI and RPLI policies today.