Ranjan

Immanuel College

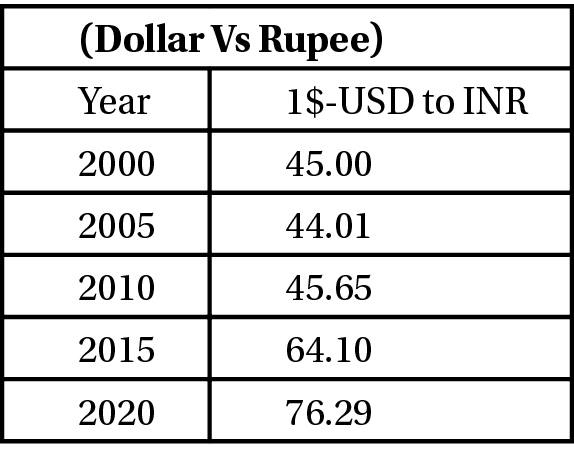

Presently, Rupee is under volatile trend, caused by sudden changes in demand and supply forces in foreign Markets. In a very short span Rupee has depreciated more than 20% US dollar (USD) to Indian Rupee (INR) exchange rate reached highest in its life time 76.29 INR on 6th May 2020.

Today, one of the most important reasonsfor the devaluedIndian Currency is rise of oil price. Due to this, country is paying more in foreign currency.

The rupee depreciation affects the Indian economy in several ways. Some of the point impacts of rupee depreciation are as follows:

• Volatility of Rupee has adverse effect on profitability, revenue, expense, cost, loans and making our companies in competitive in international business.

• Weakening rupee will also make capital items import expensive, hampering the development of India’s industrial sector and will adversely affect manufacturing competitive and capacity.

• Depreciation of Rupee is escalating planning for higher studies in abroad.

• Global rating agencies will revise our rating downward to “Junk” status, making International borrowing difficult and even more expensive for India.

• Foreign acquisition plans by Indian companies have become more expensive.

Hence, we can say that the Rupee decline adversely affect the whole Economy.

The decline of Rupee value is a warning signal for the India economy. The decrease in the value of Rupee affects all sectors of the economy. Due to the trade war in US and china there is fear in Indian economic also. Moreover, the government should take initiatives to encourage the foreign investment to large extent and not only for short term. RBI and government co-operation may help to stabilise and save the Rupee rather than playing “Blame Game”. Efforts should be made to reduce Import and encourage Export to lower deficit level.