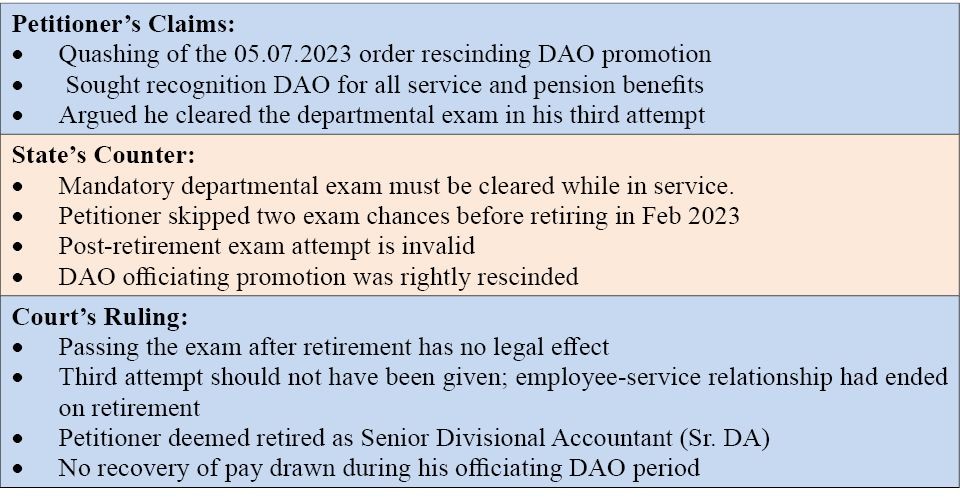

Kohima, December 1 (MExN): The Kohima Bench of the Gauhati High Court (GHCKB) has dismissed a writ petition filed by a retired government employee seeking recognition of his officiating promotion to Divisional Accounts Officer (DAO) for pensionary benefits, ruling that mandatory departmental examinations must be cleared during service and not after retirement.

Justice Unni Krishnan Nair passed the order while hearing the petition filed by an employee, who challenged a Finance Department notification rescinding his officiating promotion and downgrading his status to Senior Divisional Accountant (Sr DA) for pension computation.

The petitioner had served as Assistant Divisional Accountant from 1988 and was regularised as Junior Divisional Accountant in 1998. He received officiating promotions to Sr DA in 2010 and subsequently to DAO in September 2020.

However, the officiating promotion was explicitly made subject to clearing departmental examinations prescribed under Rules 9 and 10 of the Nagaland Treasuries, Accounts and Audit Service Rules, 2002.

The Court noted that the petitioner was given two opportunities to appear for the required departmental examination while in service but did not do so. He retired in February 2023 without fulfilling the mandatory requirement.

Though the petitioner was later allowed to sit for a third attempt in July 2024, over a year after retirement, and passed the examination, the Court held that such a post-retirement attempt had no legal effect.

“On superannuation, the employee-employer relationship ceases. The petitioner could not be deemed a member of the service after retirement,” the Court observed, terming the third attempt “not permissible.”

Upholding the Finance Department’s decision, the Court ruled that the rescinding of the officiating promotion was not erroneous, as the condition precedent for regularisation had not been met.

It further clarified that while petitioner will be deemed to have retired as Sr. DA, his pay and allowances drawn during his officiating tenure as DAO would not be recovered and would be counted for pension computation.