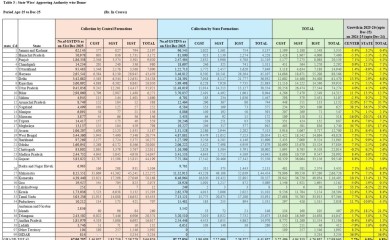

Growth much higher than all-India average GST revenue growth of 6.8% for the same periodDimapur, January 2 (MExN): Nagaland has recorded the highest growth in Goods and Services Tax (GST) revenue among all Indi

Support The Morung Express. Your Contributions Matter Click Here

GST

- States top contributors honoured on GST Day 2025DIMAPUR, JULY 1 (MExN): The Office of the Commissioner of State Taxes, Nagaland, in collaboration with the Commissioner of Central GST, Dimapur, observed GST Day

- Morung Express NewsDimapur | May 18Nagaland collected Goods and Services Tax (GST) amounting to Rs 122 crore in April 2025, the highest ever for the state in any month since the implementation of the tax regime

- New Delhi, May 1 (IANS) The country's gross GST revenue collection for April this year soared to the highest ever level at Rs 2.10 lakh crore, Finance Minister Nirmala Sitharaman announced on Wednesday.This rep

- New Delhi, April 2 (IANS) The surge in GST collections which have crossed the Rs 2 lakh crore mark for 2023-24 reflects the strength of the Indian economy across sectors and regions of the country and augurs we

- New Delhi, November 1 (IANS) The gross GST revenue in October rose by 5.7 per cent to Rs 1,72,003 crore from Rs 1,62,712 crore in September.Of the Rs 1,72,003 crore GST collections, Rs 30,062 crore was CGST, Rs

- Kohima, October 16 (MExN): A GST workshop was conducted by the Central GST Commissionerate Dimapur in collaboration with Department of Industries & Commerce, Government of Nagaland, NAGABOTS Incubation Cent

- New Delhi, October 7 (IANS) In the year of the millet, the GST Council today exempted millet flour from GST.Food preparations in powder form containing at least 70 per cent millets will not have to pay any GST,

- New Delhi, October 5 (IANS): Homegrown vernacular social gaming platform WinZO on Thursday announced the launch of its app in Brazil, as gaming companies in the country feel threatened by a massive 400 per cent

- New Delhi, October 5 (IANS) The GST Council is likely to introduce an 18 per cent tax rate on corporate guarantees extended by parent companies to their subsidiary firms for getting loans from banks, according

- New Delhi, September 28 (IANS): The Central Board of Indirect Taxes and Customs (CBIC) is prepared to implement the 28 per cent GST (Goods and Services Tax) rate on online gaming, casinos and horse racing from

- New Delhi, August 11 (IANS) Parliament on Friday passed the amendments in the Central GST as well as Integrated GST legislations to allow 28 per cent levy on full face value of bets placed in casinos, horse rac

- New Delhi, August 3 (IANS): As the 51st GST Council meeting stayed firm on taxing online gaming at 28 per cent on gross value collected, industry players on Thursday once again criticised the decision, saying t

- New Delhi, July 30 (IANS) In six years since the introduction of the Goods and Services Tax (GST), the government has detected 5,070 fraud cases of GST registration misusing PAN and Aadhaar details of people to

- New Delhi, July 26 (IANS) India's online gaming sector has experienced remarkable growth, with over 15 billion game downloads and a user base exceeding 500 million in 2022. The industry made a significan

- New Delhi, July 19 (IANS): "Ban gaming. Banish it." An Indian pro gamer has in a tongue in cheek open letter responded to statements made by the revenue secretary of India, that labelled gaming as bei

- New Delhi, July 15 (IANS) Around 127 online gaming companies and organisations have written an open letter to the government, urging it to reverse the 28 per cent GST on the full deposit value and segregate ski

- New Delhi, July 8 (IANS) Aiming to plug tax evasion through fake billing, Centre has brought the GST Network (GSTN) under the purview of Prevention of Money Laundering Act (PMLA). This will give more power t

- New Delhi, July 9 (IANS) The Goods and Services Tax (GST) council, which is set to meet on July 11, is likely to give clarity on whether tax collected at source (TCS) should be deducted by the buyer or the e-co

- New Delhi, July 4 (IANS) The Congress on Tuesday hit out at the BJP-led Central government over inflation and unemployment, saying the prices of the essential commodities like the vegetables prices have soared